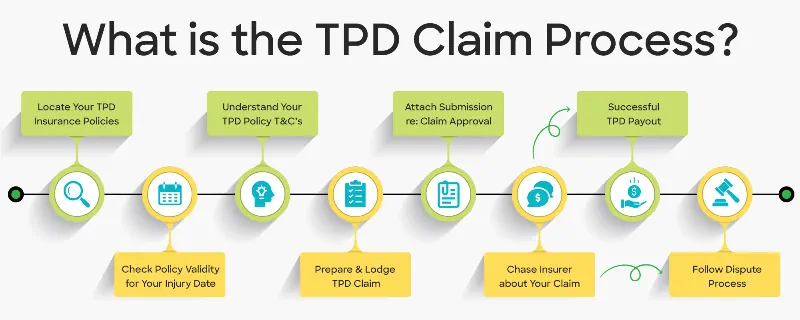

Our guide to the five steps to a successful TPD claim covers everything from the TPD claim process to the typical TPD payout. We’ll also discuss important topics like TPD insurance, income protection, and some frequently asked questions about why claims might be rejected and what to do when you haven’t received your payout. So, whether you’re filing a TPD claim due to a motor vehicle accident, a mental illness, or a physical injury, we’re here to help.

Step 1: Understand Your TPD Insurance Policy

When it comes to making a TPD claim, the first step towards success is to understand your TPD insurance policy. It is important to read the policy document thoroughly, paying attention to the key points such as the waiting period, the definition of permanent disability, the exclusions, and the benefits.

The waiting period is the time that must pass before you can make a claim. The definition of permanent disability is also critical, as it determines whether you meet the criteria for a successful TPD claim. You should also be aware of any exclusions in the policy, such as pre-existing conditions or certain types of injuries that may not be covered. Additionally, it is important to know what benefits are available to you, such as a lump sum payment or ongoing financial support.

If you have any doubts or questions about your TPD insurance policy, clarifying them with your insurance provider before proceeding with the claim is essential. Failure to understand the policy’s terms and conditions can result in a rejected claim, so it’s best to ensure that you completely understand your policy.

By taking the time to understand your TPD policy, you can ensure that you are prepared to claim your TPD benefits successfully. This step may seem small, but it can make a significant difference in the outcome of your claim.

Step 2: Gathering Medical Evidence

Gathering sufficient medical evidence is crucial for a successful outcome when making a TPD claim. Insurance companies require valid evidence of the claimant’s medical condition to assess eligibility for TPD benefits. Therefore, it is crucial to obtain medical records from all relevant medical practitioners and specialists who have treated your disability.

It is also essential to obtain a medical report that specifies the diagnosis, treatment, and prognosis of the permanent disability. The medical report should include details of the condition and how it affects the claimant’s daily life, including their ability to work. The report will provide the insurance company with a clear understanding of the claimant’s condition and its impact on their life, which will help determine whether the claimant meets the criteria for benefits.

It’s worth noting that the medical evidence should be current, relevant, and reliable. Any evidence that is deemed inadequate or outdated may affect the approval of the TPD claim. Therefore, ensuring that all the medical evidence is up-to-date and obtained from qualified medical practitioners is crucial.

By obtaining all relevant medical records and a detailed medical report, the insurance company can assess eligibility for TPD benefits. Ensuring that the medical evidence is current, relevant, and reliable is important to increase the chances of a successful TPD claim.

Step 3: Completing the TPD Claims Form

When filing a TPD claim, it is of the utmost importance to complete the claim forms accurately and thoroughly. The forms serve as the primary document for the insurer to assess the claim, so missing or providing incorrect information can potentially result in claim rejection. The required details may include personal, employment, medical, and policy information. Providing all the necessary information helps the insurer evaluate the claim promptly and efficiently.

In some cases, the claims process can be complicated and may require assistance from a legal expert or financial advisor. Seeking professional help can ensure that the claim forms are filled out correctly and that all required information is provided. Moreover, a legal expert or financial advisor can guide the TPD claims process and explain the possible outcomes of the claim.

It’s worth noting that the claims process may vary depending on the insurer, so it’s important to be aware of the specific requirements of the policy. Generally, the claim form must be submitted to the insurer along with supporting documents such as medical certificates, police reports, and employment records.

Completing your TPD forms accurately and significantly increases the chance of a successful TPD claim. Seeking professional help from a legal expert or financial advisor can be beneficial, especially for those who are unsure about the claims process or the required details.

Step 4: Submit the TPD Claim and Wait for Approval

Submitting the TPD claim is the last step in the process of claiming the TPD benefit. It is important to remember that the exact TPD claim process varies between insurance providers and superannuation funds. However, the process generally involves submitting the TPD claim form and supporting documentation to the relevant insurance provider or superannuation fund.

After submitting the TPD claim, the insurance provider or superannuation fund will review the claim and determine if the applicant is eligible for the TPD benefit. The time frame for the approval of the TPD claim varies depending on the case’s complexity, but it typically takes several weeks to several months.

If the approval process is delayed, it is important to follow up with the insurance provider or superannuation fund to ensure that the claim is being processed. If the claim is denied or delayed, legal advice from a TPD lawyer or financial advisor may be necessary to understand the options available and challenge the decision.

3 Reasons Why a TPD Insurance Claim May be Denied

The exact claims process varies from company to company, but in general, your insurance coverage, if approved, should be able to meet your needs to cover medical expenses and day-to-day life when you can’t work. Here are just three key instances we often see that lead to denied TPD compensation claims.

The TPD claim does not fully align with the definition of TPD cover

To successfully make a TPD claim, you must address certain key points. Firstly, you must show that you stopped working due to an illness or injury. Secondly, you must demonstrate that you cannot return to work for a certain waiting period, which is typically several months. Finally, you must prove that it is unlikely or impossible for you to return to any occupation for which you have suitable education, training, or experience.

Insufficient Medical Evidence

Not providing enough evidence is one of the leading reasons why TPD claims are rejected. Insurance companies typically require detailed medical reports from treating doctors and specialists to prove that the claimant is totally and permanently disabled. If the medical evidence is incomplete or insufficient or only describes a partial disability, the insurance company may reject the claim. Many claimants fail to provide the necessary evidence, which can result in their claims being denied.

Failure to Disclose Prior Medical Expenses or Conditions

A common mistake that can lead to TPD claims being rejected is not disclosing pre-existing medical conditions or previous injuries that could have contributed to the disability. Insurance providers often conduct thorough investigations and medical examinations to determine the cause and extent of the disability, and any failure to disclose relevant information can be seen as fraudulent and lead to the claim being rejected. However, mental illness TPD claims can still be made if the appropriate steps are taken.

Step 5: Receive the Lump Sum TPD Payout

Receiving a lump sum TPD payout can be a major financial relief for individuals who have successfully claimed total and permanent disability (TPD). Once the TPD claim is approved, the payout process begins.

The first step is to understand the terms of the payout. It is important to know whether the payout is tax-free or taxable, as this will affect the amount of money received. Generally, TPD payouts are tax-free, but it is crucial to seek advice from a financial advisor or a tax professional to understand the tax implications.

When receiving a TPD payout, planning for the future and considering long-term financial security is important. Seeking financial advice can help you manage your lump sum payment and create a plan for investment or savings. This can ensure that the funds are managed wisely and help secure the individual’s financial future.

While receiving a TPD payout can provide financial relief, it is important to understand that it may affect Centrelink disability support pension benefits. Therefore, it is important to check the terms of the insurance coverage and understand any impact on benefits.

Individuals may sometimes receive multiple TPD payouts due to having multiple TPD policies. In such cases, it is important to keep track of the different policies and understand the terms of each payout to ensure that the funds are managed effectively.

What Can I Do If I Don’t Receive My TPD Payout?

Waiting on your TPD payout can be an anxiety-inducing experience; what’s more is, in some cases, the insurers will not always act within the bounds of the TPD insurance policies, often shortchanging those who are unfamiliar with their insurance arrangements and laws.

If you are concerned or this has happened to you, it is important to know that you have rights that are enforceable under the insurer’s policy if they fail to act in good faith, act unfairly or unreasonably in the processing of your claim. If you do not receive the correct entitlements or they do not arrive promptly, you also have the right to issue court proceedings to compel payment from your insurer. Additionally, a court can also rule on any disputes that may arise during a claim’s processing. We recommend consulting TPD lawyers with experience to help guide you through this kind of difficult situation.

When you suffer a total and permanent disability and are unable to work, receiving a TPD payout could be crucial for your financial security. The TPD claims process can be complicated and confusing, and making mistakes or omissions may result in your benefits not being approved. Following the 5 steps outlined in this guide can increase your chances of successfully claiming your TPD benefits. Remember to gather all the necessary information, seek professional help if needed, and avoid common mistakes such as not providing adequate medical evidence or failing to disclose previous medical conditions.

Related Reading: Get The Most Out Of Your TPD Payout: Your Ultimate Guide

Please do not hesitate to contact our team of experienced TPD lawyers at Aussie Injury Lawyers if you need assistance with your TPD claim. We’re here to provide you with expert legal advice and help you navigate the often-complex TPD claims process. Contact us today to schedule a free consultation and learn more about how we can assist you in getting the TPD payout you deserve.