Understanding Superannuation Insurance Claims

You could claim superannuation insurance benefits when you cannot work

Our skilled life insurance lawyers offer expert legal advice for death benefit claims with a 99% win rate on a 100% No Win, No Fee basis. If a loved one has passed and you need to make a life insurance claim, Aussie Injury Lawyers can assist.

Death benefit or life insurance coverage is typically included in your superannuation policy. This means if someone close to you has passed away or has a terminal illness, insurance claim experts can help you make a successful life insurance claim.

When someone close to us dies, it can change our lives in many ways: emotionally, socially, and financially. This impact will be compounded if the deceased were a source of income for their dependents. Get immediate legal support now by Calling 1300 873 252.

All Australian superannuation funds offer death benefits in the event of a loved one’s passing. Which means, if you are a spouse, child, legal personal representative or financially dependent on someone who has passed away, you might be entitled to their super contributions and connected insurance benefits. These benefits can help ease the burden of financial strife at this challenging time.

Our life insurance claim lawyers are experts in successful death benefits claims. They have helped many people get the money they need to bounce back and regain control over their lives. Discover how they can help you – It’s free to get started.

With more than one hundred years of combined legal experience and a 99% success rate, our legal team specialise in superannuation death benefit and life insurance claims. Every day we help Australians access all the benefits contained in their or their loved ones’ superannuation accounts.

Our 100% No Win No Fee legal funding policy supports all our life insurance-related legal services, which means you only pay when you win; there are no fees to start or ongoing costs.

Aussie Injury Lawyers will ensure the efficiency of your claim, so our legal fees are modest. Before we begin work on your case, we will establish a fixed or capped cost with the departed’s family, so you have certainty of your commitment and the payout you will receive. Ask our legal team for a free estimate now by Calling 1300 873 252.

There are different types of life insurance claims that Australians can make depending on the terms of their policy and the circumstances of their illness, disability or demise. Here are some of the common types of life insurance claims:

You can make a TPD claim when a Total and Permanent Disability stops you from working in your regular occupation. Both physical and psychological injuries or illness can qualify for a lump sum TPD payout, which can be substantial with some people about to make multiple claims.

You can claim income protection insurance benefits when you are temporarily unable to work due to an injury or illness. When approved, you will be paid a percentage of your regular earnings, providing financial support during the recovery period.

Beneficiaries of a policyholder can claim death benefits when the insured person dies. An insurance payout helps support the deceased’s dependents and covers expenses like funeral costs and medical bills.

An insured person can claim terminal illness benefits when diagnosed with a terminal illness with a limited life expectancy. A successful terminal illness claim provides a lump sum payment to the policyholder, providing a comfortable life at a difficult time.

A trauma policyholder can lodge a trauma claim when they suffer a specific medical illness or disorder like heart attack, stroke, or cancer, irrespective of their life expectancy.

A diagnosed mental illness could qualify for an insurance payout (or other legal claims) depending on how it was acquired and the insurance you have in place.

In Australia, you can only claim on a life insurance policy if you are a dependent of the deceased. Generally, a financially dependent person is someone who is wholly or partially reliant on the deceased for financial support. Financial dependents are often de facto partners (including same-sex partners), spouses and children.

If you are a financial dependent of the deceased, you must act quickly to make a death benefits claim. Contact Aussie Injury Lawyers for help with claiming a life insurance payout through the departed’s superannuation insurer. Call Now – 1300 873 252

Claiming death benefits or life insurance can be challenging at an already stressful time in your life. Multiple issues can arise when negotiating with a life insurance company that may seek to minimise or deny your entitlements. Furthermore, it can be overwhelming to get multiple information requests from the insurer or trustee, and how you answer these requests is crucial for a successful payment.

Aussie Injury Lawyers have substantial skill and expertise when dealing with insurers and trustees. We will quickly address their demands and ensure that the correct information is delivered promptly.

Give yourself your best chance of winning a swift death benefit settlement. Call Now – 1300 873 252

After the passing of a loved one, it’s crucial to be aware of the different benefits that may be provided when you have a valid life insurance claim. These benefits offer financial security to help cover expenses and support dependents following the insured’s death. Here are some of the common types of benefits available through life insurance claims:

If you are an Australian superannuation fund member, you likely enjoy a number of benefits, like discounted life and disability insurance policies. These policies provide income or a lump sum payment to a member (or their beneficiaries) when they become injured, ill or pass away.

Superannuation death benefits are typically paid in the form of a lump sum or super income stream to a dependent beneficiary, like a spouse, child, or financially dependent, or to the member’s legal representative.

Generally, the process for accessing superannuation death benefits can be complicated and must follow the rules of the Superannuation Industry (Supervision) Regulations 1994 (SISR). Trustees must adhere to these regulations and consider a range of factors when making a decision about benefit payments.

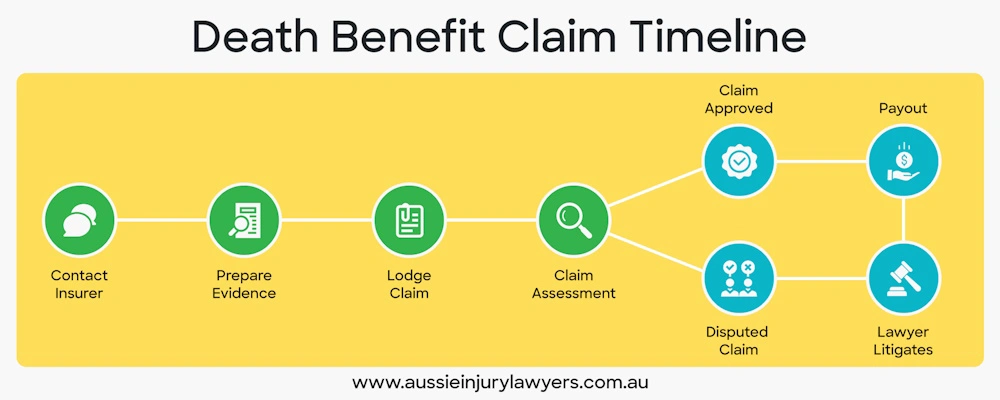

The process of claiming death benefit claims varies depending on the policy and superannuation fund regulations. Generally, a death certificate and other identification documents must be provided, along with proof of their dependent status, financial dependence, and relationship to the deceased.

Once the claim is lodged, the fund administrator or insurer will assess the claim and make a decision regarding a payout. If disputed, claimants can seek legal advice from an insurance claim lawyer who can provide expert representation.

Insurance lawyers help clients understand their rights, represent them in disputes, and appeal denied claims when required.

Claimants should get legal help if the death benefit claim involves a terminal illness or distribution of payments among surviving dependents.

A Terminal Illness benefit is a lump sum pre-payment of an insurance death benefit financial support when diagnosed with a life-threatening medical ailment that cannot be cured, leading to death within a particular period. This benefit can be claimed either when the insured person passes or when they have been diagnosed with a terminal illness.

As well as their insurance entitlements, people diagnosed as terminally ill can access the money in their Superannuation fund even before they reach the age when they are eligible to access their super account.

To be eligible for Terminal Illness Benefits, you must meet specific requirements outlined by your policy terms, which typically include a terminal illness diagnosis from a medical practitioner or specialist.

The death benefit claim process is the last thing anyone wants to worry about after a loved one passes. Knowing what to expect and how to handle it can reduce stress and anxiety during a difficult time.

The 5 step death benefit claim process is as follows:

Additionally, there can be strict time limits to make a claim, and informed legal advice will be invaluable if the insurer disputes your case claim decision or there are additional legal costs.

Ideally, your submission is prepared by a skilled insurance claim lawyer, which will help smooth the process and increase your chance of getting your desired result.

When the deceased bought life insurance cover (or it was created through their superannuation) they should have allocated beneficiaries so they can be identified quickly by the insurer. Ideally, the policyholder will have identified their beneficiaries by providing the required personal details.

A beneficiary is designated whereas an heir is assumed. If someone dies without having made a will, then his or her next of kin are the people who would be legally eligible to inherit the deceased‘s property. They may have named one or more heirs as beneficiaries on a policy. There are several reasons why the deceased might have named someone else as a beneficiary besides their spouse, children or grandchildren.

A person who purchases a life insurance policy can choose whether their beneficiaries are revocable or irrevocable. Beneficiaries who are irrevocable cannot be removed from a policy or changed their share without their consent, so it can be difficult to modify these aspects of an insurance plan. Revocable beneficiary changes are fairly simple and you don’t usually require permission unless it is the deceased’s spouse and you live in a common property state.

Life Insurers sometimes attempt to reduce the value of an insurance benefit claim in some situations including:

Some life insurance policies include accelerated death benefits (optional provision) which allow policyholders who have a terminal illness to access some of their death benefits while they’re still alive. Usually, this helps them pay for necessary medical expenses. A life insurance policy may require proof of life expectancy from a medical provider before they will pay out any benefits.

Life insurance companies learn of an insured’s death and then use the information they have available to them to attempt to locate all beneficiary accounts. However, people often share similar names and can be difficult to locate. They might not be looking for beneficiaries because they haven’t received a death certification yet and don’t know whether the insured person has passed away.

If you have an older family member who has not yet made any decisions regarding his or her estate, you should ask him or her whether he or she has named you as a beneficiary for his or her final assets. You should check whether there is any change in the company’s policies regarding this issue. Also, if you already knew about the policy, then you should find out where the relevant documents are stored so that they can be accessed when needed.

Wherever you are in Australia, you are just a phone call away from informed legal advice relating to life insurance and death benefit insurance claims. Aussie Injury Lawyers run all legal claims on a 100% No Win No Fee basis, and your claim review is free. Call Now 1300 873 252

In Australia, a life insurance claim lawyer is a legal expert who specialises in helping people with their insurance claims. They are expert lawyers who help access the maximum benefits under their insurance policy in the event of death or terminal illness. Life insurance lawyers have the expertise and experience to handle disputes over claim decisions and denials with insurers.

Additionally, they investigate the claim on the policyholder’s behalf, collate compelling evidence, and communicate with insurance providers to ensure the claim is quickly resolved.

A life insurance litigation lawyer’s primary role is to help clients navigate the complex legal process involved in making a winning claim. Their responsibilities include:

Most importantly, life insurance claim lawyers will ensure your claim meets the definitions of your policy and the insurer’s expectations, giving you a stress-free and speedy resolution.

Hardworking and straight talking, our experienced superannuation and insurance legal team is dedicated to delivering results for you. We understand how challenging life can be when things go wrong and we are here to help you get back to normal. The expert team at Aussie Injury Lawyers is led by Kerry Splatt, an Accredited Specialist in Personal Injuries law. His expertise together with over 100 years of combined legal experience is your guarantee of success. Reach out. Let us show you how we can assist you and your loved ones when the unexpected happens.

You could claim superannuation insurance benefits when you cannot work

When you have a cancer diagnosis, you could make several

You can claim life insurance while still alive in certain