Can You Claim on Multiple TPD Policies?

Can You Claim on Multiple TPD Policies? Unveiling the Truth!

When you are unable to work due to an injury, our TPD lawyers help you make a total and permanent disability claim through your superannuation fund and receive an insurance lump sum payment.

Selecting the best TPD claims lawyers increases the likelihood of winning TPD compensation. A lump sum payment is deposited into your super fund account when you have a successful outcome.

Please get in touch with our total permanent disability legal experts when you want a TPD claim approved. Relax knowing Aussie Injury Lawyers is a 100% No Win, No Fee law firm with a 99% success rate and no upfront fees.

It’s FREE to know if you can claim – Call Now 1300 873 252

The expert TPD claim lawyers at Aussie Injury Lawyers have substantial expertise in just one area of law: superannuation TPD insurance claims.

Our highly experienced TPD lawyers work on TPD insurance claims for everyday Australians every day. So, your best chance of a successful outcome is to work with solicitors who have the knowledge and experience to prepare a detailed, professional legal case.

Like most Aussies, you want the best legal team on your side when you can’t work because of an injury or illness. A successful TPD benefit paid into your superannuation account provides funds to pay your rent, mortgage, bills, and food.

It’s free to know your legal entitlements and the claims you could make – Call Now 1300 873 252 or email us >

Unlike some superannuation TPD lawyers, Aussie Injury Lawyers is a 100% No Win, No Fee law firm. Our No Risk policy means you have no upfront or ongoing legal costs for the life of your TPD insurance claim.

Pay our costs when you win and zero if you lose. Furthermore, we cover your disbursement expenses (medical evidence and legal reports) until we achieve your settlement, which means you carry no financial risk for your case.

Plus, before we start working on your case, we will give you a capped or fixed price for your insurance claim.

Get a fast quote now by calling 1300 873 252

Many superannuation funds provide TPD cover to their members. So when you are unable to work due to an injury, medical condition, or psychological illness, you may be able to make a Total and Permanent Disability (TPD) claim through your superannuation provider.

Many people are unaware they are entitled to a TPD benefit, usually paid in one TPD lump sum payment. If you have stopped working and need extra money, these funds can be vital to helping you get your life back on track after a challenging time. Ask our highly experienced TPD lawyers for your best legal strategy. Call Now: 1300 873 252

Contact a TPD lawyer now for specialist legal advice regarding disability insurance claims, and disputed claims. Give yourself the best chance of success.

Please speak with our experienced TPD lawyers to learn about your rights. It’s free to know where you stand, and you owe us nothing until we win your claim. – Call 1300 873 252.

To have a successful TPD claim, you do not need to prove that your illness or injury resulted from your regular job or workplace.

In Australia, you can make a TPD claim for a wide range of physical injuries, mental illnesses and medical conditions like stroke, heart attacks, cancer, terminal illness, Alzheimer’s, significant burns, organ transplants and many more.

Our total and permanent disability claim lawyers will work with you to demonstrate that you cannot work in your regular occupation (or another job for which you have experience or qualifications). Generally, there is no need to show you cannot work at all in any field, just the ones in which you are qualified or have training and experience.

It’s free to know if you can claim, so Call 1300 873 252

You claim TPD compensation for any medical ailment that stops you from working in your usual occupation. Suppose you suffer from a mental health disability, such as depression, anxiety, bipolar disorders, post-traumatic stress syndrome (PTSD) and other recognised psychiatric or psychological conditions. In that case, you may be able to claim your TPD benefits.

Most people with a chronic illness will qualify to claim their disability insurance entitlements. Any illness that prevents you from performing in your current occupation can be the basis of a successful case.

It is common for Aussies to be unaware of their legal right to a TPD payout or income protection benefits.

Many Aussie workers have Total and Permanent Disability (TPD) insurance cover in their superannuation fund membership, but many don’t know what they can claim on their insurance policies.

The excellent news is that if you have contributed to multiple superannuation funds during your working life, you could make multiple TPD claims for the same total and permanent disability.

Contact our legal team now for a free case evaluation to determine if this applies to you – Call 1300 873 252

Unlike workers’ compensation, any ailment that stops you from working can qualify for a TPD claim. However, some common medical conditions that qualify as a total permanent disability for insurance purposes include the following:

Any physical injury that prevents you from working can also qualify, particularly serious medical harm like:

Be sure of your legal rights by contacting our experienced TPD lawyers for your free claim review.

Income protection insurance (also known as disability insurance or income replacement) provides financial support to people who can’t work due to illness, injury or temporary disability. This type of insurance policy is designed to replace some of a person’s lost wages while they cannot perform their regular role. Income protection benefits help pay the bills until you recover or provide support until you qualify for a permanent disability claim.

Daily, Aussie Injury Lawyers helps everyday Australians negotiate challenging legal processes and procedures to access the insurance benefits contained within their superannuation. Our TPD claims lawyers are ready to help, wherever you are in Australia. Choose your capital city office locations:

Total and Permanent Disablement (TPD) insurance gives financial security to people who have suffered an injury or illness that prevents them from working again.

TPD insurance coverage is designed to provide financial compensation to help people with the costs of medical treatments, rehabilitation, and other expenses associated with their disability. When you have a successful outcome, a TPD insurance benefit is paid as a lump sum to help people adjust to their new circumstances.

You can choose to make a TPD Claim without a lawyer. Remember that insurance providers protect their profits by paying out the least amount they can afford, and a lack of legal representation may facilitate that process. If you must receive your maximum entitlements, a solid, experienced legal team will give you the best chance of success.

Don’t settle for less; settle for more. Highly experienced TPD lawyers work on TPD insurance claims daily and have in-depth knowledge of the best legal strategy to maximise your lump sum payment. They are used to dealing with insurance companies who seek to minimise your payout. Leave the heavy lifting to Aussie Injury Lawyers so that you can de-stress and recover from your medical condition.

A Total and Permanent Disablement (TPD) benefit is typically an insurance lump-sum payment determined by the date you stopped working due to your illness or injury. If you have TPD through a superannuation provider, it usually includes your account balance.

Depending on your circumstances, you may need to pay tax on your TPD benefit. TPD payouts can also impact Centrelink payments. You can choose to minimise tax by leaving some or all of your payout in your Super fund.

A permanent disability is a physical or mental condition that will persist throughout a person’s lifetime. A state from which they may never recover or likely continue indefinitely.

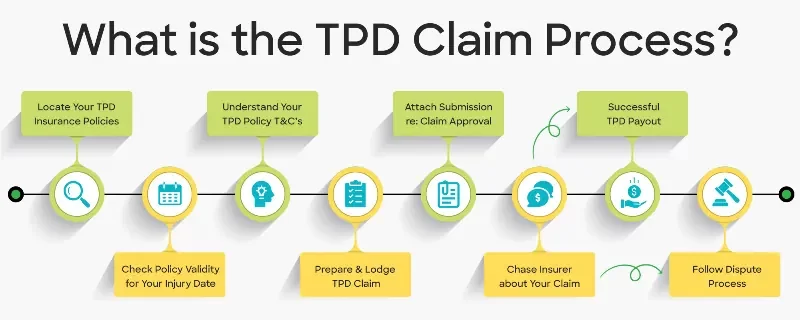

Typically, a TPD Insurance Claim takes between 6 and 12 months to reach an outcome. Most often, insurers complete their assessment within six months. However, investigating your insurance policy and preparing your case can take up to 6 months.

Thankfully, Aussie Injury Lawyers have a fast-track legal process that can deliver a favourable outcome in a shorter period, so get started now >

Time limits for TPD claims differ across Australia. They could be anywhere from a few months to 6 years. For disability claims, the standard period would be six years. There could be no time limit for some medical conditions that take many years to develop. Contact our legal team for free advice to determine which time limitations may apply to your case.

Several factors determine the difficulty in accessing the benefit contained within your TPD insurance cover. These factors include:

If you are covered for being unable to work in any occupation rather than your usual occupation, your claim may be more straightforward. Generally, you only get one chance to make a successful TPD claim.

If your claim is denied, an option is to contest the result, which is often expensive and may not be successful. Give yourself the best chance of success with Aussie Injury Lawyers. Call now for your free case review – 1300 873 252

In Australia, the average payout for a successful TPD claim ranges between $ 50,000 and $ 500,000, with some eligible Aussies able to make multiple tpd claims. Ask a TPD lawyer at AIL to know how much you might get in a lump sum payment.

Hardworking and straight-talking, our experienced superannuation insurance lawyers are dedicated to delivering results for you. We understand how challenging life can be when things go wrong and we are here to help you return to normal. Kerry Splatt, an Accredited Specialist in Personal Injuries law, leads the expert team at Aussie Injury Lawyers. His expertise, together with over 100 years of combined legal experience is your guarantee of success. Reach out. Let us show how we can assist you and your loved ones when the unexpected happens.

Can You Claim on Multiple TPD Policies? Unveiling the Truth!

Being sick or injured is never fun, but knowing you

The definition of Total and Permanent Disability (TPD) depends on