Can You Claim TPD and TTD at the Same Time? Exploring the Differences

You can claim TPD and TTD insurance benefits simultaneously; however,

If you can’t work due to an illness or injury, our expert superannuation lawyers help you make an insurance claim through your Super or other insurance policy, on a 100% No Win No Fee basis.

You could make a superannuation claim through your disability or life insurance policies and get a lump sum payment when you can’t work due to an injury or illness.

As an Aussie worker, you have a retirement superannuation account funded by your employer. If you become injured or ill, you may be able to access a range of insurance benefits contained within your superannuation fund membership.

Most people have insurance attached to their superannuation accounts. You may be eligible to claim when you are injured or ill and off work. Furthermore, your health condition does not have to be related to your job, as with a workers’ compensation claim.

Insurance claims can be complicated but worth pursuing, with lump-sum payouts ranging between $1 million and $ 5,000 (as a rough guide). So, our dedicated superannuation lawyers will help you make a claim to access your superannuation insurance benefits, 100% no win, no fee.

Contact us now for your free case review – 1300 873 252

You could still have a claim, no matter how you acquired your illness, injury, or mental health condition. People on a disability pension, receiving NDIS, with a worker’s compensation or car accident claim, and those with a severe medical condition preventing them from working could all have a viable claim.

It is good to know that when you choose Aussie Injury Lawyers to manage your superannuation insurance claim, you are dealing with a law firm with a track record for success. Due to our many years of legal experience, we consistently achieve a 99% success rate. Find out for yourself how we deliver these excellent results. Contact us now

Aussie Injury Lawyers offers all Australians a free initial case review. Our claim assessment thoroughly analyses your unique situation and your opportunity to make one or several claims. We will help you understand the legal process for your type of claim and our fees. We aim to make it easy for you to pursue your legal entitlements with minimal fuss.

Shareholder profits typically drive superannuation funds and insurance companies, so it is becoming more challenging for members to get the insurance benefits owed to them. Thankfully, Aussie Injury Lawyers has a strong, experienced legal team who will relentlessly pursue your interests to hold insurers responsible for their legal commitments.

Aussie Injury Lawyers will run your legal claim on a 100% No Win No, Fee basis. You pay nothing until we win your case. Our funding includes legal costs that may occur along the way, e.g., for medical and expert reports and assessments.

Knowing you will pay nothing if you lose is reassuring, as you have no financial risk. Furthermore, we charge an hourly rate only for our work on your legal file, and these Fees are Capped.

The number and type of Superannuation and insurance claims you can have are depend on the insurance cover contained within your Super policy. These could include:

Waiting periods can apply before you lodge a claim with your Superannuation provider. The period may vary depending on the type of claim and the nature of your illness or injury.

Our experienced superannuation lawyers will help you understand your unique situation when contacting us.

When you get paid a benefit from an insurance claim, the money you receive is not taken from the funds in your existing Super account. Your payout will be taken from an insurance policy contained within your Superannuation – you can relax knowing your current Super balance won’t be impacted by your claim.

If this is your situation, you may have a viable claim.

Not sure if you have a valid claim? Ask Us Now

It costs nothing to understand your legal options for making an insurance claim.

There are different terms and conditions in each insurance policy. However, for your claim to be successful, you’ll need to prove that you’ve been unable to work for at least 3 or 6 months due to an injury or illness. Generally, you must prove the following:

Your superannuation fund’s most recent member statement may tell you what level of Income Protection or Total and Permanent Disability (TPD) coverage you have. For private policies, your insurance policy schedule will confirm your coverage.

To determine how much your claim is worth, we need to examine your facts. We can help you understand the criteria you need to meet to receive your insurance benefits.

Our expert superannuation insurance claim lawyers will support you through the process of disputing the insurer’s ruling, avoiding court proceedings. In this situation, the insurer will typically send us a pro-fair letter giving us a chance to remedy their decision.

Aussie Injury Lawyers have successfully reversed the findings of most rejected claims, saving our clients the risk, stress and costs associated with litigation.

Understanding that every legal case is unique, involving various superannuation funds and different insurance policies, is essential. The complexity or simplicity of your superannuation insurance claim will impact the time it takes to complete it and the costs associated with achieving your payout. There are, however, some steps that are common with all legal claims.

Please share your story with us so we can investigate your superannuation claim.

Our insurance lawyers will work with you to get your super fund information, and we will examine it in detail.

Chat with one of our experienced staff, who will get information regarding your illness, injury, or medical condition. They will answer your questions and explain the legal process.

Once you agree to work with Aussie Injury Lawyers, we build a compelling case with medical evidence from your treating doctors, your Workcover files, tax records, or Centrelink information.

If it is necessary to support your case, you will have an independent medical examination.

Once we have everything, we will prepare your submission and submit the claim form and attachments to your super fund and insurance company.

When we have the desired outcome, your funds will be deposited into your super account (in most cases), where you can withdraw them at your convenience. If your claim is denied, our lawyers will guide you through the dispute process and seek to reverse the decision.

A superannuation lawyer provides legal representation and advice for people who wish to make a claim for their superannuation insurance benefits. They have expertise in litigating insurance policies like TPD insurance, life cover and income protection.

Expert superannuation lawyers will guide you step-by-step through the claims process to a successful outcome.

Knowing if you claim claim a superannuation insurance benefit can be tricky. But Aussie Injury Lawyers will investigate your case for free. Our superannuation lawyers will help you understand if you can make a claim, your superannuation benefits, our legal fees, and what it takes to have a successful claim.

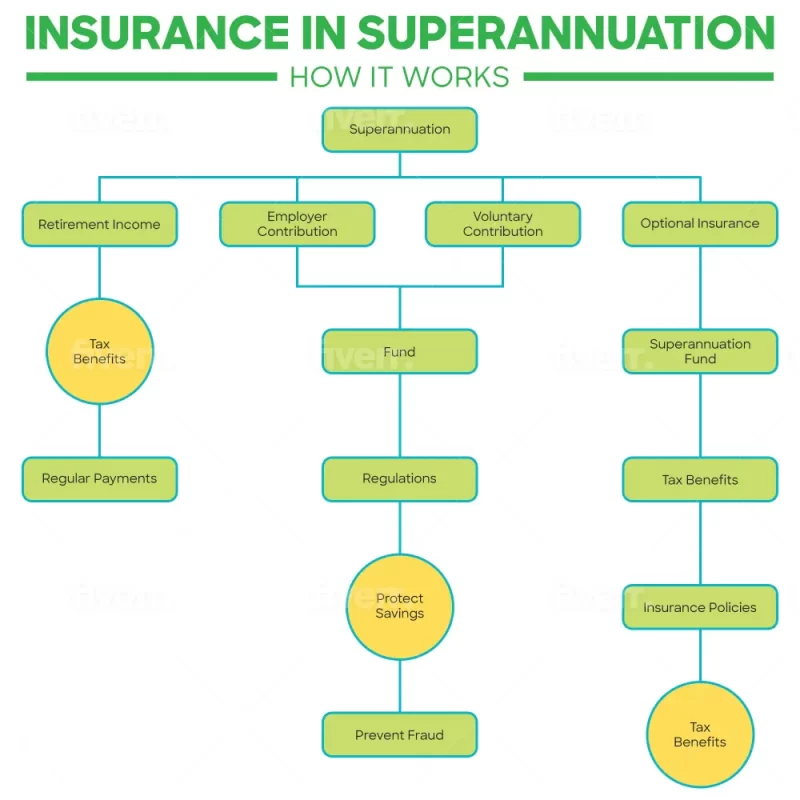

Superannuation is a type of long-term savings scheme designed to provide Australians with a reliable source of income during retirement. Because the Australian Taxation Office (ATO) is in charge of this program and there are government regulations, it is subject to certain legal obligations.

One requirement is that your employer pay compulsory superannuation contributions. Another is that your superannuation fund be managed responsibly, thus ensuring the protection of your retirement savings.

When you have a successful super injury claim, the value of your lump sum payment relies on several factors including:

The type of insurance claim

Your current salary

Your age at the time of injury

The value of your insurance cover

Aussie Injury Lawyers will provide an estimated payout figure as part of your complimentary case evaluation. Get yours now by Calling 1300 873 252

Hardworking and straight-talking, our experienced superannuation insurance lawyers are dedicated to delivering results for you. We understand how challenging life can be when things go wrong and we are here to help you return to normal. Kerry Splatt, an Accredited Specialist in Personal Injuries law, leads the expert team at Aussie Injury Lawyers. His expertise, together with over 100 years of combined legal experience is your guarantee of success. Reach out. Let us show how we can assist you and your loved ones when the unexpected happens.

You can claim TPD and TTD insurance benefits simultaneously; however,

In the context of insurance contracts, the term good faith

You can claim life insurance while still alive in certain