- 100% No Win No Fee

- 99% Win Rate

- Capped or Fixed Prices

- 24 Hour Payouts

- We Cover Outlays

Are you a beneficiary of a life insurance policy who must make a death benefit claim? The process can be overwhelming, especially when coping with a loved one’s passing. However, by understanding the necessary steps, you can guarantee a seamless and effective insurance payout during this challenging period. In this article, we’ll provide a comprehensive guide on how to make a death benefit claim, including eligibility requirements, required documents, common issues, and delays.

How to Make a Death Benefit Claim: Key Points

- Our legal guide explains the death claim process

- Provides a step-by-step guide for claimants

- Covers eligibility, required documents, and receiving payment

Introduction to Life Cover

Life cover (often known as life insurance) is a vital part of a sound financial plan. When you buy life insurance, you make sure that your chosen beneficiaries will get a lump sum payment, called a death benefit, if something bad happens to you. This lump sum can be used to cover funeral costs, pay off outstanding debts, and help with ongoing living expenses, reducing financial stress at a difficult time.

Many life insurance policies do more than provide cover for a person’s death. For example, they may also offer terminal illness or trauma insurance cover. If you get a serious illness or injury, these benefits can give you a lump sum or ongoing payments to help you out when you need it most. By having life cover in place, you can be confident that a death benefit is paid to your nominated beneficiaries so they can maintain their quality of life after your death.

About Death Benefit Claims

A death benefit claim is a request to an insurance company or superannuation fund by a life insurance policy’s legal personal representative or beneficiary to receive a benefit payout following the insured’s demise. Death cover is the insured amount the policy holder chooses for themselves (also known as the death benefit).

• To receive a lump sum death benefit, you must lodge a claim with the super fund holding the deceased’s account.

• Once approved, the insurance benefit is credited to the member’s account before being paid out to the nominated beneficiary or, if none, to the deceased’s legal personal representative.

• When successfully claimed, the beneficiaries receive a tax-free lump sum payment.

• These funds can help cover funeral expenses, medical bills, and other financial obligations.

• If there is no nominated beneficiary, the insurer or super fund pays the death benefit to the deceased’s legal personal representative, who then distributes it according to the will or intestacy laws.

• If there are no eligible dependents, the benefit may be paid to the deceased’s estate.

Members of all Australian superannuation funds typically receive life insurance cover automatically. The dependents of the deceased can then claim the super death benefit policy (and the account balance) when the member dies.

Successful Lump Sum Death Benefit Payment

The claims process has several common roadblocks and pitfalls. Your best chance of receiving a death benefit lump sum payout is to seek legal advice from an experienced insurance claim lawyer who understands the process and the steps to a winning claim. Our superannuation law experts work on a 100% no-win, no-fee basis. For immediate support – Call Now 1300 873 252.

Types of Life Insurance Policies

There are two main types of life insurance in Australia: term life insurance and permanent life insurance. Both kinds of policies are meant to pay out death benefits to the people who are named as beneficiaries when a person dies.

Term life insurance policies typically cover a fixed period, usually 10–30 years. The beneficiaries get a death benefit payment if the policyholder passes away during the policy term. However, if the insured person outlives the policy term, it expires with no payout for surviving dependents.

Permanent life insurance policies offer financial protection for the entire lives of policyholders as long as they keep paying insurance premiums. Typically, you can also withdraw against the cash value component of these policies or borrow up to 90% of the insured value on request. Finally, upon the policyholder’s demise, a lump sum benefit is made to the beneficiaries as part of the deceased’s estate.

More about life insurance claims >

Identifying the Relevant Superannuation Fund

The process of making a super death benefit claim begins after a member’s death. One of the first steps is to find the superannuation funds to which the deceased person was a member. Some Australians have held various jobs throughout their lifetime and have multiple superannuation death benefit policies. Here are the steps to follow:

Gather Information

Begin by gathering information about the deceased’s employer. Each employment provider will have a default superannuation provider, and the departed may have multiple.

Contact the Employer or ATO

They should contact their employer or the Australian Taxation Office (ATO) to locate their superannuation funds. All Australian companies are required to contribute to their employees’ superannuation accounts, ensuring employees are aware of their active accounts.

Check Financial Records

The departed’s financial records and personal documents, such as bank statements or tax returns, will also help identify additional superannuation accounts. They may have arrangements with multiple funds, especially if they changed jobs or made voluntary contributions.

Aussie Injury Lawyers’ Free Claim Investigation

Aussie Injury Lawyers charge nothing for a comprehensive claim investigation. We will locate the relevant super funds, retrieve insurance documents and let you know your claim eligibility. As part of this process, we will provide a fixed or capped price to manage your case, with an estimate of the death benefit payment you could achieve. Contact us now to get started.

Types of Death Benefit Payments

There are different ways to receive death benefit payments. Here are the common options:

- A lump sum payment gives a one-off amount of money to the nominated beneficiaries. They can then use this lump sum right away to pay for things like funeral expenses, or they can invest it for long-term financial security.

- Some superannuation funds and life insurance policies, on the other hand, let you choose an income stream. With this plan, the death benefit is paid out in regular instalments over a set period of time, so the beneficiaries can pay for their ongoing living expenses.

If the main beneficiary dies, a reversionary beneficiary can be named to receive the income stream. This way, financial dependents can still get help.

The choice between a lump sum and an income stream will depend on the policy holder’s individual circumstances and the beneficiaries’ needs and preferences.

Income Protection Insurance and Death Benefits

Income protection insurance is designed to provide financial support if you are temporarily unable to work due to illness or injury. Typically, they don’t provide death benefits, but you may be able to buy additional cover.

If you are considering buying income protection insurance, you should review the policy details carefully to understand:

- The benefits that are included

- How payments are made

- If the policy includes a death benefit

Eligibility to Make a Death Benefit Claim

To make a death benefit claim, you must be a beneficiary listed on the policy or be a financial dependent of the departed. Age can affect eligibility, particularly for minors, as benefits for those under 18 are typically managed by a legal guardian until they become an adult child.

• Eligibility may also depend on death benefit nominations, including binding nominations, made by the deceased member.

• Before starting the claim process, please ensure you are a named beneficiary and that the policy is up-to-date and accurate.

• Eligible claimants can include the member’s spouse, former spouse, or other dependents of the deceased member’s estate.

- In certain circumstances, non-dependents may also be eligible to receive a death benefit, but the tax treatment may differ.

- If a dependent has a permanent disability, special rules may apply to the payment of the death benefit.

- For minor children, the benefit may be paid to a legal guardian until they reach legal age.

If you want to find out if you are a beneficiary, contact the insurance provider and request a copy of the insurance policy. This will show all beneficiaries and the share of the benefit payment each will receive.

Can I make a death benefit claim? >

What is the Definition of a Dependent?

A financial dependent is someone who relies on the deceased for their living expenses and any joint financial responsibilities. This usually includes the deceased’s de facto partner or spouse, their children, and any other financial dependents.

- A person may also be considered a dependent if they were in an interdependency relationship with the deceased at the time of death.

- An interdependency relationship exists when there is a close personal relationship between two individuals who live together and provide each other with financial support, domestic support, and personal care.

- This definition includes a de facto partner or spouse who was in a close personal or interdependent relationship with the insured party, as recognised by the legislation in their Australian state of residence.

A child includes adopted children, stepchildren, a spouse’s children, ex-nuptial children or someone defined as a child by the Family Law Act 1975.

Beneficiary Nominations

A financial dependent is someone who relies on the deceased for their living expenses and any joint financial responsibilities. This usually includes the deceased’s de facto partner or spouse, their children, and any other financial dependents.

Supporting Documents for Death Benefit Claims

To successfully claim a superannuation lump sum death benefit payout, you’ll need to have all the required supporting documents (including relationship proof), such as:

• A death certificate and a birth certificate

• Passport

• Marriage certificate

• Letters of administration

• Copy of the life insurance policy

• Each beneficiary’s identification documents.

The death certificate is the key document for the above, as it confirms the policyholder’s death.

In some cases, additional documentation may be required to determine the tax-free component and taxable component of the death benefit payout.

You can contact the funeral home, care facility, or hospital where the death occurred to get a copy of this vital information. You can also get an official version by contacting their state’s Registry of Births, Deaths, and Marriages online, by post, or in person.

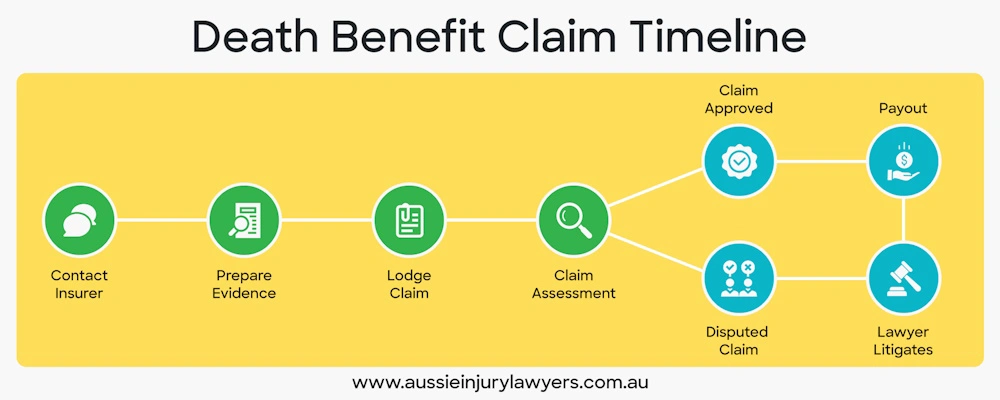

Steps to a Successful Death Claim Process

The claim process begins when a member dies. Each super fund has its own rules for the handling of death benefit claims, including provisions for reversionary income streams, beneficiary nominations, and trustee discretion. Here are the steps to a successful death benefit claim.

- Get effective legal representation by hiring an experienced life insurance claim lawyer.

- Inform the superannuation insurance provider of the death by email, phone, or mail.

- Prepare documents and evidence.

- Accurately complete the claim forms.

- Follow up with the insurer to ensure they have all the necessary information for a decision.

- Claim approved or denied.

- If a claim is denied, a lawyer can challenge the decision and seek to have it reversed.

Death Benefit Payment

A death benefit payment is the financial support given to the beneficiaries of a deceased member’s superannuation account. Once a death benefit claim is approved by the superannuation trustee, the payment can be made as a lump sum or, in some cases, as an income stream, depending on the fund’s rules and the beneficiary’s circumstances. This benefit payment is designed to help those who were financially dependent on the deceased member, easing financial stress and assisting with living costs during a difficult time.

• It’s vital to know how death benefit payments are taxed, as some are tax-free and others are taxable, depending on the beneficiary’s relationship to the deceased and the superannuation benefit’s components.

• The Australian Taxation Office can explain the tax implications of death benefits.

• Beneficiaries can also consult a financial adviser about the correct tax treatment for their circumstances.

What are the Death Benefit Claim Time Limits?

In Australia, time limits apply for superannuation death benefit claims, but, as with any legal matter, you should start immediately. Please be aware that some superannuation fund members will have a binding death benefit nomination, which means they have designated a beneficiary.

However, when there is no nominee or a non-binding nomination, the superannuation trustee can decide who is dependent, split up the account or hand it over to the deceased estate. For this reason, you need an experienced insurance claim lawyer representing your interests.

Common Reasons for Denied Claims

| Reason for Denial | Explanation |

| Policy Lapse | If the insured person stops paying premiums, the insurance may lapse, and the death benefit expires. |

| Suicide | If the policyholder commits suicide within the first two years of the policy, there will not be a paid death benefit. |

| Misrepresentation | The insurance company has a two-year contestability period after issuing the policy. If the policyholder passes away during this period, the insurance company can investigate and deny the death benefit claim if it finds evidence of fraud or misrepresentation. |

| Contestability Period | If the policyholder commits suicide within the first two years of the policy, there will not be a paid death benefit. |

| Exclusions | Some policies have exclusions that specify circumstances under which no death benefit payment will occur. Common exclusions include death due to drug or alcohol abuse or participating in hazardous activities. |

Avoiding Delays in a Death Benefit Claim

To ensure your death benefit claim progresses smoothly, it’s essential to provide accurate and complete information from the outset. Delays in the claim process often occur when:

• Required documents are missing

• When a legal personal representative needs to be appointed for the deceased member’s estate

• There are multiple beneficiaries involved

• Incomplete beneficiary nominations

• Outdated contact details

• The need for additional certified documents

To avoid unnecessary setbacks, make sure the superannuation fund has your current contact details and that all beneficiary nominations are up to date. If you are aware of any family complexities or potential disputes, address these early in the claims process.

Resolving Disputes Over Death Benefit Claims

Disputes over death benefit claims can arise for a variety of reasons, such as:

• Disagreements between multiple beneficiaries

• Unclear beneficiary nominations

• Questions about the deceased member’s wishes

In these situations, it’s crucial to consult a financial adviser or a lawyer who specialises in superannuation law. They can assist you in understanding the relevant legislation, the fund’s governing rules, and your rights as a potential beneficiary.

If a dispute cannot be resolved directly with the superannuation fund, the Australian Financial Complaints Authority (AFCA) offers an independent avenue for resolving death benefit claims disputes.\

How to Make a Death Benefit Claim FAQs

Who can make a death benefits claim?

The deceased person’s surviving spouse or de facto partner typically has the legal right to claim death benefits. In some cases, other relatives, like children, parents, siblings, or ex-spouses, can also seek a lump sum benefit. Additionally, any person financially dependent on the deceased at the time of death may also be eligible.

How long does it take to receive a death benefit payout?

The time it takes to receive a death benefit payout varies depending on circumstances, but is generally about 4 to 6 weeks. It also depends on the complexity of the claim, whether the insurer needs additional documents, and whether the claim is disputed or denied.

Who should I contact to make a death benefit claim?

First, contact Aussie Injury Lawyers for expert legal advice regarding your circumstances, and then inform the relevant insurance company of the deceased’s passing.

What if the insurance company denies my claim?

If you have a denied death benefit claim, it is crucial to understand why and be persistent in ensuring you receive your due benefits. Reversing a claim denial is challenging and best handled by an experienced insurance litigation lawyer.

Your best strategy is to contact Aussie Injury Lawyers for a free case assessment. Call Now – 1300 873 252

How much money can I expect to receive?

The amount of money you receive varies depending on the policy value, premiums paid, whether retirement funds are in the superannuation account and the number of death benefit dependants.

Aussie Injury Lawyers will provide a settlement estimate for your free claim review. This valuation will help you understand whether pursuing a death benefit claim is worthwhile.