Are you a life insurance policy beneficiary who must make a death benefit claim? The process can be overwhelming, especially when coping with a loved one’s passing. However, it’s essential to understand the steps involved to ensure a smooth and efficient insurance payout during this difficult time. In this article, we’ll provide a comprehensive guide on how to make a death benefit insurance claim, including eligibility requirements, required documents, common issues, and delays.

How to Make a Death Benefit Claim: Key Points

- Explains the process of claiming death benefits

- Provides a step-by-step guide for claimants

- Covers eligibility, required documents, and receiving payment

Understanding Death Benefit Claims

A death benefit claim is a request to an insurance company or superannuation fund by a life insurance policy’s legal personal representative or beneficiary to receive a benefit payout following the insured’s demise. Death cover is the insured amount the policy owner chooses for themselves (also known as the death benefit).

When successfully claimed, the beneficiaries receive a tax-free lump-sum payment. Often, the recipients use the funds to cover funeral expenses, medical bills, and other financial obligations.

Generally, all Australian superannuation funds provide life insurance coverage (or death benefits) for their members. Hence, dependents of the deceased can claim against this policy and the remaining superannuation account balance.

Please be aware that this can be a complex process with several roadblocks and pitfalls. Your best chance of a successful death benefit payout is to seek legal advice from an experienced insurance claim lawyer who understands the process and the steps to a winning claim. For immediate support – Call Now 1300 873 252.

Types of Life Insurance Policies

Before making a death benefit claim, you should understand the different life insurance policies. In Australia, there are two primary types of life cover: term life insurance and permanent life insurance.

Term life insurance policies cover a fixed period, usually 10–30 years. The beneficiaries get a death benefit payment if the policyholder passes away during the policy term. However, if the insured person outlives the policy term, it expires with no payout for surviving dependents.

Permanent life insurance policies offer financial protection for the entire lives of policyholders as long as they keep paying insurance premiums. Typically, you can also withdraw against the cash value component of these policies or borrow up to 90% of the insured value on request. Finally, upon the policyholder’s demise, a lump sum benefit is made to the beneficiaries as part of a deceased estate.

More about life insurance claims >

Identifying the Relevant Superannuation Fund

When making a death benefit claim, one of the first steps is to find the superannuation funds that apply to the deceased person. Some Aussies have worked in different jobs throughout their lifetime and have more than one super account and multiple insurance policies. Here are the steps to follow:

Gather Information

Begin by gathering information about the deceased’s employer. Each employment provider will have a default superannuation provider, and the departed may have multiple.

Contact the Employer or ATO

They should contact their employer or the Australian Taxation Office (ATO) to find their superannuation funds. All Australian companies must contribute to their employees’ superannuation accounts so they will be aware of their active accounts.

Check Financial Records

The departed’s financial records and personal documents, like bank statements or tax returns, will also identify additional superannuation accounts. They may have arrangements with multiple funds, especially if they changed jobs or had voluntary contributions.

Aussie Injury Lawyers’ Free Claim Investigation

Aussie Injury Lawyers charge nothing for a comprehensive claim investigation. We will locate the relevant super funds, retrieve insurance documents and let you know your claim eligibility. As part of this process, we will provide a fixed or capped price to manage your case, with an estimate of the death benefit payment you could achieve. Contact us now to get started.

Eligibility to Make a Death Benefit Claim

To make a death benefit claim, you must be a beneficiary listed on the policy or be a financial dependent of the departed. Before starting the claim process, please ensure you are a named beneficiary and that the policy is up-to-date and accurate.

If you need to know if you’re a beneficiary, you can contact the insurance provider and get a copy of the insurance policy, which will list all beneficiaries and the percentage of the benefit payment that each will receive.

Can I make a death benefit claim? >

What is the Definition of a Dependant?

A financial dependent is a person who relies upon the person who died for their living costs and any joint financial obligations. Typically, this includes the deceased person’s de facto partner or spouse, their children, and any other financial dependents.

A de-factor partner or spouse was in a close personal relationship or interdependent relationship with the insured party as recognised by the legislation in their Australian state of residence.

A child includes adopted, stepchildren, spouse’s children, ex-nuptial child or someone defined as a child by the Family Law Act 1975.

Supporting Documents for Death Benefit Claims

To successfully claim a superannuation death benefit payout, you’ll need to have all the required supporting documents (including relationship proof), like:

- A death certificate and birth certificate

- Passport

- Marriage certificate

- Letters of administration

- Copy of the life insurance policy

- Each beneficiary’s identification documents.

The death certificate is the essential document of the above, as it proves the policyholder’s passing.

You can contact the funeral home, care facility or hospital where the death occurred to get a copy of this vital information. You can also get an official version by contacting their state Registry of Births, Deaths, and Marriages online, by post, or in person.

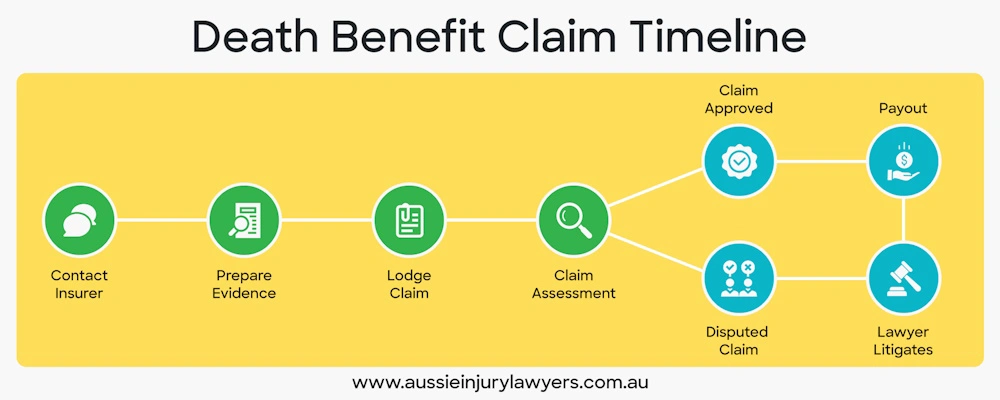

Steps to a Successful Death Benefit Claim

Here are the steps to a successful death benefit claim.

- Get effective legal representation by hiring an experienced life insurance claim lawyer.

- Inform the superannuation insurance provider of the death by email, phone, or mail.

- Prepare documents & evidence.

- Accurately complete the claim forms.

- Follow up with the insurer to ensure they have everything they need for a decision.

- Claim assessment – you wait for an answer.

- Either a successful lump sum benefit payment or a rejected claim

- Your lawyer challenges their decision and seeks to have it reversed.

What are the Death Benefit Claim Time Limits?

In Australia, time limits apply for superannuation death benefit claims, but, as with any legal matter, you should start immediately. Please be aware that some superannuation fund members will have a binding death benefit nomination, which means they have designated a beneficiary.

However, when there is no nominee or a non-binding nomination, the superannuation trustee can decide who is dependent, split up the account or hand it over to the deceased estate. For this reason, you need an experienced death benefit claim lawyer representing your interests.

Common Reasons for Denied Claims

| Reason for Denial | Explanation |

| Policy Lapse | If the insured person stops paying premiums, the insurance may lapse, and the death benefit expires. |

| Suicide | If the policyholder commits suicide within the first two years of the policy, there will not be a paid death benefit. |

| Misrepresentation | The insurance company has a contestability period of two years after issuing the policy. If the policyholder passes away during this period, the insurance company can investigate and deny the death benefit claim if they find evidence of fraud or misrepresentation. |

| Contestability Period | If the policyholder commits suicide within the first two years of the policy, there will not be a paid death benefit. |

| Exclusions | Some policies have exclusions that specify circumstances under which no death benefit payment will occur. Common exclusions include death due to drug or alcohol abuse or participating in hazardous activities. |

Getting Reliable Financial and Legal Advice

When making a death benefit claim, getting reliable financial and legal advice will increase your chance of correctly navigating the insurance claim process. Here are the steps to follow:

Seek Financial Advice

Contact a qualified financial adviser who specialises in superannuation and estate planning. They will guide the relevant superannuation laws and regulations and help you understand your potential claims, beneficiaries, and ATO tax implications.

Hire a Legal Representative

Engage a legal representative experienced in handling superannuation insurance settlements. They will advise on the legal aspects of making a death benefit claim, including evidence, asset distribution, and insurance policy terms and conditions.

Discuss Potential Claims

Work closely with your financial adviser and legal representative to discuss potential legal claims. They will help establish your eligibility as a potential beneficiary and advise your best actions based on the deceased person’s circumstances and the relevant superannuation laws.

Understand Tax Implications

Death benefit taxation laws can be complex, so make the most of your payout by understanding how to minimise tax obligations.

Death Benefit Claim FAQs

Who can make a death benefits claim?

The deceased person’s surviving spouse or de facto partner typically has the legal right to claim death benefits. In some cases, other relatives, like children, parents, siblings, or ex-spouses, can also seek benefits. Additionally, any person financially dependent on the deceased at the time of death may also be eligible.

How long does it take to receive a death benefit payout?

The time it takes to receive a death benefit payout varies depending on circumstances but is generally about 4 to 6 weeks. It also depends on the complexity of the claim, whether the insurer needs additional documents, and whether the claim is disputed or denied.

Who should I contact to make a death benefit claim?

First, call Aussie Injury Lawyers for expert legal advice regarding your circumstances, then contact the relevant insurance company to inform them of the deceased’s passing.

What if the insurance company denies my claim?

If you have a denied death benefit claim, it is crucial to understand why and be persistent in ensuring you receive your due benefits. Reversing a claim denial is challenging and best handled by an experienced insurance litigation lawyer.

Your best strategy is to contact Aussie Injury Lawyers for a free case assessment. Call Now – 1300 873 252

How much money can I expect to receive?

The amount of money you receive varies depending on the policy value, premiums paid, whether retirement funds are in the superannuation account and the number of death benefit dependants.

Aussie Injury Lawyers will provide a settlement estimate for your free claim review. This valuation will help you understand whether pursuing a death benefit claim is worthwhile.