How Much Do Lawyers Charge for TPD Claims?

Finding an affordable and dependable TPD lawyer when making a TPD claim can be challenging. So, it’s understandable to have questions about the cost of having a successful claim.

Thankfully, Aussie Injury Lawyers’ experienced TPD lawyers provide guidance and support throughout the claims process and offer an upfront capped price quote for your permanent disability claim. Call now for your free claim review and a quote for legal costs: 1300 873 252

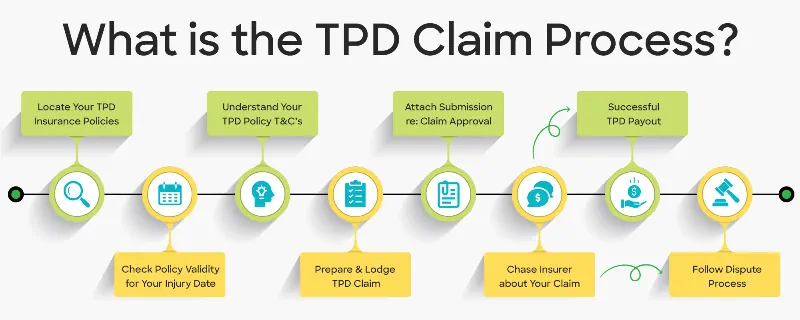

About TPD Claims

In Australia, you can make one or more total and permanent disability claims if you have an illness, injury, or medical condition (including mental illness) that stops you from working in your usual occupation. Usually, your TPD insurance entitlements are held as a superannuation insurance policy, but you may also have coverage through a private insurance company.

Winning a total and permanent disability claim through a superannuation policy or as part of a personal injury claim will give you a TPD lump sum payment. Thankfully, an insurance payout can help fund your life until you can access your superannuation fund retirement income stream.

100% No Win, No Fee TPD Claims

No win, no fee. It’s a simple idea that can make a big difference for anyone considering making a TPD claim. After all, no one should worry about the cost of pursuing their legal entitlements.

If you think you have the basis for making a super TPD claim, you are probably aware that most law firms offer no win, no fee funding for insurance claims. Which eansyour case costs are deducted from your payout once you have a successful TPD claim.

What you pay for legal services is usually based on the number of hours of work that has gone into achieving your outcome, as well as fees for any medical reports or assessments and other sundry costs.

How Much Does a TPD Claim Cost?

The cost of a TPD claim may vary due to factors including the case’s complexity, lawyer experience, and the work hours required to achieve a successful TPD payout. Injury law firms typically offer legal services on a no-win, no-fee basis, meaning payment is only required when they win your claim. Settlement fees are typically calculated as a percentage of the total settlement amount and can vary by firm.

Unlike other insurance claim law firms, Aussie Injury Lawyers has a 100% no win, no fee policy. Our popular funding policy means you:

- Pay when you win

- Nothing if you lose

- And we do not charge a percentage of your payout.

Instead, we charge only for the effort required to deliver a successful outcome, and you will have a capped upfront price or fixed fee before we begin work on your case. Ask our no win, no fee lawyers how it works.

Get a quick, competitive quote now >

Three Factors Affecting TPD Claim Costs

1. Complexity of Insurance Claims

The complexity of a TPD insurance claim calls for further investment of time and resources, which will result in higher costs. Additional medical evidence and expert opinions may be necessary in cases involving multiple injuries or illnesses.

2. Amount of Work

The work hours necessary to achieve success will impact the cost of your claim. Cases requiring extensive documentation, medical reports, and evidence-gathering may take longer than straightforward cases.

3. TPD Lawyer’s Experience

Your TPD lawyers’ expertise will also determine their fees. those with more experience typically charge more than those without. However, experienced lawyers can handle cases faster and cost-effectively with maximum compensation.

TPD Claims for Less Than You Expect

Like with most things in life, the cost of legal services varies. You might be relieved that, in many cases, the price of a total and permanent disability claim is less than you expect. Of course, this can depend on your case and situation.

The cost of running a successful TPD claim depends on the simplicity or complexity of your claim. If you have had this type of claim before, you might know that the charges are generally less than for other types of injury claims. Most likely, less than you might expect.

How long can a TPD payout claim take? >

Understanding your TPD entitlements

You’ve probably never needed to use your superannuation before, and most likely, you have never looked at it in detail. For this reason, many Aussies don’t know or understand the TPD benefit contained within their superannuation policy.

So why would you understand how to claim against your TPD cover and, most importantly, get the maximum you are allowed? This is where an experienced TPD lawyer can assist you.

Ask About Our Capped Legal Fees

At Aussie Injury Lawyers, we only charge you for the work we do to achieve a successful outcome, and this amount is capped. When you work with our illness and injury claim law firm, you will know at the beginning of the TPD claims process the maximum amount you will pay when we achieve a settlement. If your claim were unsuccessful for some reason, you would pay nothing.

You can relax knowing what you will pay when your claim succeeds; you won’t get a vast and unexpected legal bill.

We know your funds will likely be limited if you cannot work anymore, so we offer 100% No Win No Fee to all our TPD Claim clients.

We Don’t Charge a Percentage of Your TPD Insurance Payout

We understand you work hard to access your entitlements, so:

- We don’t take a percentage of your payout

- Our legal fees are calculated based on the number of hours we work on your case.

- You will have transparency, so there are no surprises. You will understand the work that makes up your legal fee.

- An independent assessor oversees your legal fees for your case.

- You will know the fixed price of your claim before we begin work on your case.

How Much Will Lawyers Charge for My TPD Insurance Claim?

If you’re considering claiming your TPD insurance benefits, it’s crucial to understand how much lawyers charge for TPD claims. At Aussie Injury Lawyers, we offer free case assessments so you can get an idea of what your legal matter is worth, our legal costs, and your options.

We work on a 100% no-win, no-fee basis, so no risks are involved in talking to us about your claim. To find out more or to book a free case assessment, call us today at 1300 873 252

How Much Do Lawyers Charge for TPD Claims FAQs

Can I make multiple TPD claims?

Some hard-working Aussies have contributed to multiple superannuation funds during their careers. Changing jobs often makes people unaware they have multiple TPD insurance cover. Thankfully, people in this situation can be eligible to make more than one claim for the same permanent disability.

Ask an Aussie TPD lawyer to investigate your circumstances, explain the claim process, and determine your potential benefit amount. It’s free to know where you stand.

How do I know if I can make a TPD claim?

You can make a TPD claim when an illness, injury, or mental illness permanently makes you unable to work, and you have permanent disability insurance cover. Unlike a workers’ compensation claim, your medical condition does not need to be work-related. However, to approve a TPD claim, you must provide medical evidence that satisfies your policy definitions.

That’s when experienced TPD lawyers can assist. A specialist TPD lawyer will help you understand the eligibility criteria and if you have a valid claim.

How much compensation do I get for a successful claim?

The value of the insurance benefits included in your superannuation fund policy determines how much compensation you receive for a TPD insurance payout. If you qualify to file multiple TPD claims, you will have a substantially higher lump sum payment.

Aussie Injury Lawyers will investigate your TPD insurance terms at no charge and advise how much you can expect for an approved TPD claim. Get started now by calling 1300 873 252

Should I hire a lawyer for a TPD claim?

Anyone in Australia can file a TPD claim without a lawyer’s assistance. However, when paying TPD benefits, an insurance company often seeks to minimise or deny liability. They typically challenge your medical reports and other evidence that satisfies your TPD definition.

Life insurance claim data from APRA, shows that more than 20% of TPD claims are denied annually. And, of course, many of the approved claimants had effective legal representation. So, your best chance of a successful outcome is to work with the support of an expert TPD lawyer.

What is the average TPD payout in Australia?

In Australia, average TPD payouts range between $50,000 and $500,000. However, some fortunate people can make multiple claims and typically receive a six-figure insurance benefit payment. Ask AIL how much we charge for TPD claims now.

How long does it take to settle a TPD claim?

Most TPD claims are settled between six and 12 months. However, some complex cases (typically with large payouts) can take up to two years. That’s because insurance companies are more likely to challenge large insurance claims.

Does a TPD claim affect Centrelink payments?

Until you reach pension age, Centrelink will not assess funds transferred from a TPD payout into your superannuation account. However, these funds could impact Centrelink payments when you make a withdrawal.