Can You Claim on Multiple TPD Policies?

Can You Claim on Multiple TPD Policies? Unveiling the Truth!

Our experienced Melbourne insurance lawyers provide expert legal advice for insurance claims when you can’t work due to a temporary or permanent injury, illness, or psychological disorder. In this case, you could make an income protection or TPD Claims through your superannuation fund. Thankfully, our Victorian TPD lawyers provide all legal services on a 100% No Win, No fee basis, which means you have no financial risk for your case.

It’s FREE to know if you have a valid case – Call Now 1300 873 252

Our expert Melbourne TPD lawyers are located close to the city centre at 440 Collins St in Melbourne CBD (corner of Gurners Lane and Collins St) adjacent to the post office at Collins St West.

It is easy to reach our location by tram, as the tram line runs along Collins St. The Williams St/Collins St tram stop is very close to our building. The closest train station is Flinders St which is a 9 minute walk, or 750 metres away.

Our other Australian Locations

If you want to make an insurance claim, look no further than Aussie Injury Lawyers for effective legal services that deliver your full benefits. Many people don’t know that they have more than one insurance policy contained within their superannuation fund. If you’ve contributed to a super fund during your working life, a sizable TPD payout could be available to you. Ask about us:

Accessing your full entitlements requires evidence to meet your TPD definition. Ask our expert insurance lawyers for free advice now.

![]()

You can also claim TPD benefits when a mental illness stops you from working again. First, you must be diagnosed with a recognised psychological disorder. Our legal team will help you collate all the relevant information for a winning outcome.

Regardless of life expectancy, a trauma policyholder can seek critical illness benefits when diagnosed with a specified medical condition (named in their policy terms), like stroke, cancer, or heart attack.

Our insurance law experts provide various legal services when claiming insurance policy benefits through superannuation funds. Ask expert insurance lawyers how it works.

![]()

You can claim income protection when you have a temporary medical condition that prevents you from earning an income. In this case, securing your insurance benefits relies on expert advice.

![]()

Beneficiaries of a life insurance policyholder can claim death benefits when the insured person passes. These funds help dependents cover expenditures like burial costs and medical fees.

![]()

When you have a terminal illness diagnosis with a short life expectancy, you may be eligible to receive critical illness benefits. If accepted, the policyholder receives a lump sum payout that helps them live reasonably through an especially trying period.

Don’t panic if you have a rejected insurance claim. When it comes to an insurance dispute, AIL is there for you. Our legal team has the skills required to overturn the insurer’s initial decision, including dealing with the Australian Financial Complaints Authority when required.

Our experienced Melbourne insurance lawyers have over 100 years of legal experience in insurance litigation. This means we have the knowledge and expertise to ensure you get the most from your TPD claim. Every day, we support the people of Victoria to secure their compensation entitlements from their insurance provider so they and those close to them can replace lost income due to illness or injury.

In fact, whether you live in the city or in regional Victoria, an Aussie Injury Lawyer expert is ready to help you maximise your insurance and TPD entitlements. It’s free to get started, so Call Now – 1300 873 252.

At Aussie Injury Lawyers, we understand the effect an injury or illness can have on a family if it means you can’t work and support loved ones. If you also have to worry about legal fees while seeking insurance benefits, it adds more stress to your life.

That’s why Aussie Injury Lawyers operate on a 100% no win, no cost basis for all Victorian insurance claims. There are no upfront and ongoing costs, not even for the medical reports and assessments we obtain for your case.

This means you pay absolutely nothing unless you win your TPD claim payout. And there’s more good news: we only charge for hours spent on your legal file, and these costs are capped. Get started now by Calling 1300 873 252

If you have suffered an accident, illness, or injury (or mental health condition) that has left you unable to work, all is not lost. You could be able to make a claim with your Superannuation Fund, otherwise known as a TPD claim. A long list of medical conditions may qualify for benefits, and they can be unrelated to your work. In other words, you do not have to have acquired your illness or injury at your workplace, or because of your job.

Aussie Injury Lawyers specialise in simplifying disability insurance claims so you can get on with your life, while we pursue your entitlements. We aim to remove any stress or frustration you may be experiencing and fast-track your legal case to the outcome you seek.

You could be eligible. It costs nothing to be certain of your legal rights. Find out now if you have a valid claim!

Aussie Injury Lawyers are tried-and-true TPD Superannuation Insurance claim specialists. So much so that it’s very rare for us not to enjoy maximum funding success for our clients. If you’d like to know if you qualify for a lump sum payout, please complete our quick and easy online claim check. It’s free and takes less than a minute.

There are multiple time limits for insurance claims. Your best option for success is to contact our expert insurance lawyers immediately. Wherever you are in Victoria, Aussie Injury Lawyers can assist. From Mildura to Melbourne, Portland to Mornington, and beyond, you get informed legal assistance to maximise your TPD entitlements.

TPD Insurance is often misunderstood and undervalued. If you want help understanding what your TPD Insurance is worth and how it works, you have come to the right place. Aussie Injury Lawyers are a law firm specialising in insurance claims. Our lawyers and solicitors have many years of experience in this area of law backed up by their 99% claim success rate.

When claiming your TPD insurance benefit, you do not need to show that your disability or illness came about because of someone else’s negligence. You must, however, show that your disability prevents you from doing your usual job. How you acquired your medical condition is not the primary consideration for a successful TPD claim. Our lawyers will assist you in compiling the correct medical assessments and reports to achieve a positive outcome.

Your illness or injury does not need to be work-related to have a valid claim. However, if your work medically impacts you, you may be able to have other legal cases or insurance claims. Our lawyers will help you understand your legal rights at no cost.

TPD payouts can be substantial and help transform your life at a challenging time. When your claim is approved, a lump sum amount will be deposited into your superannuation account. The value of your insurance claim is dependent on several factors. Contact our lawyers for a free case assessment, or use our TPD Claim Calculator.

The common reason for TPD claim denial is that you can still work. Insurance policies have different definitions for the circumstances under which you are assessed as unable to work. Our experienced insurance solicitors can help you satisfy the terms of your policy.

It might seem like insurance companies have good intentions, providing protection for when the unexpected happen. The truth is, they don’t always want to pay out your claim. They can use a number of tactics to delay, deny or minimise your insurance payout. Sometimes they will use your fineprint terms and conditions to say you don’t qualify for your benefit. Our experienced superannuation lawyers regularly deal with all the well-known Australian insurance companies. We know their claim lodgement expectations and the techniques they use the avoid their commitments. Aussie Injury Lawyers are relentless in the pursuit of your entitlements. We understand the complex world of insurance law. Find out how we can help you by requesting your free claim review.

Insurance companies are notorious for trying to avoid paying legitimate claims. Sometimes, they do this by inundating claimants with requests for supporting documents and forms. This tactic often works because people don’t want to deal with having to gather up all those papers and send them off to the insurance company. Or, they try to comply with all their requests, and fail.

If you receive such a request, there are several things you can do to ensure that you get paid fairly.

If you have an injury, illness or mental disorder and wish to claim your insurance benefit, it can be difficult to know how much time you have to wait for your insurance payout. It is important that you understand your rights and obligations under Australian law so that you don’t miss out on any payments or compensation. Sometimes, insurers are slow to payup at a time when you desperately need financial assistance. At times like this, you need an expert injury claim lawyer to help you succeed.

When you contact us for your complimentary case evaluation, we’ll tell you everything you need to know about making an insurance claim. Rest assured, There will be no charge until your claim is successful. During your free case analysis we will:

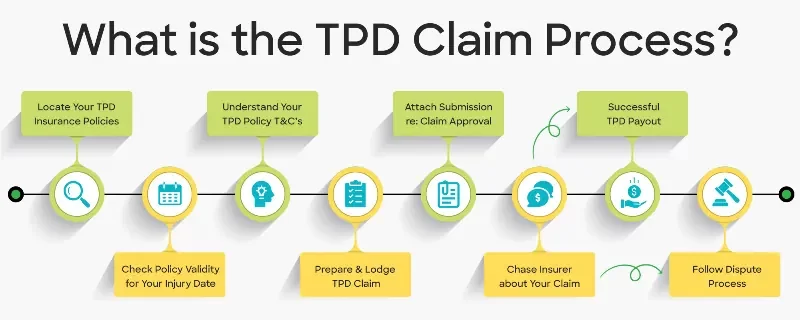

We begin following the insurance claims process once you sign our legal cost agreement.

A lump-sum payment is deposited into your superannuation account when you successfully file a TPD claim. If you don’t withdraw your insurance payout until retirement age, you will likely pay no tax on these funds. You will pay taxes from your super account when you withdraw before this time, but usually at a reduced rate.

No matter where you reside in our great state of Victoria, we have a team of TPD and insurance claim specialists ready to help. Everyone deserves qualified legal advice when they are considering claiming their legal entitlements. We support everyday Aussies from Melbourne to Mornington Peninsula, Frankston, Dandenong, Geelong, and regional areas like Bendigo, Shepparton, Barnesdale, Wangaratta, Charlton, Morwell, Falls Creek, and all surrounding locations.

You can choose a phone or online consultation at the best time that suits you! Call Now – 1300 873 252

Hardworking and straight talking, our experienced superannuation and insurance legal team is dedicated to delivering results for you. We understand how challenging life can be when things go wrong and we are here to help you get back to normal. The expert team at Aussie Injury Lawyers is led by Kerry Splatt, an Accredited Specialist in Personal Injuries law. His expertise together with over 100 years of combined legal experience is your guarantee of success. Reach out. Let us show you how we can assist you and your loved ones when the unexpected happens.

Can You Claim on Multiple TPD Policies? Unveiling the Truth!

Being sick or injured is never fun, but knowing you

The definition of Total and Permanent Disability (TPD) depends on