How long does it take to get a TPD Payout?

If you can’t work in your usual job because of an injury or illness or a mental disorder, you can make a TPD claim through your super fund. Being unable to earn an income will increase your anxiety and stress when seeking a positive outcome for your case.

As one of Australia’s leading TPD lawyers, we help injured workers claim TPD benefits through superannuation funds. The most frequent question we hear from our clients is:

What is my TPD claim worth? >

The second common query is: How long do TPD claims take? >

The simple answer is that the complexity or simplicity of your TPD insurance claim will determine the length of time required for a typical TPD payout. This article will explore the elements that impact the timing of the TPD claims process and what it takes to get a lump sum payment. Plus some steps you can take to ensure a speedy resolution.

You can get an accurate assessment of your claim length when you contact us for your free case review – Call Now 1300 873 252 or email us >

What is the waiting period for TPD Insurance claims?

You must have stopped working before claiming TPD benefits through a superannuation fund. There is a waiting period between your cease-employment and claim lodgement dates. The terms and conditions of your TPD policy will determine your waiting period. For most people, there is a 3—to 6-month delay before you can start the claim process.

If you can’t work due to an illness, injury or mental health problem and would like to understand your opportunity to make a TPD claim, please get in touch with our personal injury lawyers or solicitors for expert legal advice.

Free TPD Claim Assessment

Once you have stopped working, our compensation lawyers will investigate your TPD policy for free. You will know:

- Your waiting period.

- If you can make multiple TPD claims with several TPD payouts.

- The expected value of your lump sum payment.

- Your chance of having a successful claim.

- The likely time to get your TPD payout

Aussie Injury Lawyers has a 99% success rate. Your claim assessment costs nothing, and you owe us nothing until we win your case. So get started now.

How long will it take to make a TPD claim?

In most cases, your insurance company will pay TPD benefits within a 6- to 12-month period. Once your insurance company has received your case, there is typically a six-month assessment period. During this time, you may need to attend a medical review with the insurer’s disability assessor.

When your total and permanent disability insurer has decided, your superannuation fund trustee must also assess your claim. This review process usually takes two months.

Our legal team helps 100’s of Aussies access their TPD entitlements every year. We regularly deal with all major Australian insurance companies and understand their expectations. Our compensation claim lawyers will investigate your TPD policies for free and let you know a reasonable time frame for your case when you contact us for your free legal case review.

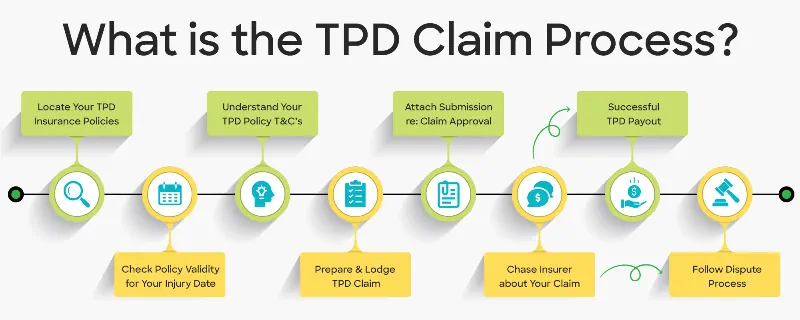

What is the TPD Claim Process?

These are the steps of the TPD claims process

- Locate all your Super TPD insurance policies

- Was your TPD cover current at the time you were injured?

- Understand your policy requirements.

- Lodge a comprehensive and compelling TPD claim form with all the substantiating evidence.

- Attach a written proposal explaining why they should approve your case.

- Contact the insurer to confirm they have everything they need to decide an outcome.

- If your claim is rejected, follow the review process.

Read more about claiming TPD benefits

What will Delay my tPD claim?

Like any legal matter, the complexity or simplicity of TPD insurance claims will impact the time frame to achieve an outcome. Generally, physical disability claims are easier to prove than those for psychological disorders. Mental illness claims are more complex as the damage is not visible.

Making a successful TPD claim relies on expert evidence. When compelling professional assessments and medical records substantiate your condition, the insurer’s decision is often straightforward.

A skilled TPD insurance lawyer knows the type of proof insurers are seeking. The evidence will make them approve your case on time. Contact our legal team for your free insurance claim review to access all your TPD entitlements faster. Call Now – 1300 873 252

Factors that Affect the Time it Takes to Process a TPD Claim

The type of TPD claim you make can significantly impact how long it takes to process your case. For example, TPD claims for physical disabilities are generally easier than those for mental illness.

The severity of your disability may affect how long it takes to process a permanent disability claim. Generally, TPD Claims with severe and well-documented disabilities will be processed faster than claims that are less severe or have poor documentation.

The availability of medical evidence will affect the time it takes to conclude successful TPD claims. Comprehensive medical evidence, such as reports from treating doctors, a medical specialist, and other health professionals, is essential to support your total and permanent disability claim.

The complexity of your case will impact the time it takes to process TPD claims. If your claim is straightforward and does not require further investigation, it may be handled faster.

Cooperation from your employer or insurance company will also impact the speed of processing your TPD claim. If either the employer or insurer disagrees, it may delay your settlement.

What evidence will I need for my permament disability claim assessment?

You will need to submit the following information for your total nad permanent disability claim:

- Medical evidence and specialist reports – expert doctor, medical practitioner, physician, psychiatrist and medical reports, treating notes and referrals.

- Your employment history – Your CV, work history, and employer reports showing your skills and training.

- Financial evidence – Centrelink reports, tax reports and your pay records.

How can I fast-track my TPD claim?

To accelerate your TPD claim payout, you must provide the following:

All permanent disability TPD insurance companies have processes for insurance claim approvals and claim forms. Your settlement will be faster when your submission meets their expectations the first time it is lodged.

Your permanent disability must be certified to claim TPD successfully. The nature of your physical injury or mental illness will determine the complexity or simplicity of this stage. For example, some psychiatric conditions trigger almost automatic approval as they are known to be irreversible. Reports from specialist doctors or psychiatrists are more compelling than those of a general practitioner.

Understanding what your insurance company will need to decide and giving it to them the first time will speed up your claim.

Our claim lawyers know how to fast-track your TPD claim. Our 99% success rate is evidence of our skill with all insurance claims. We know what your insurer needs to progress your case.

Is your existing TPD claim taking too long? Contact us now for immediate legal help. Call 1300 873 252 or email us >

What do insurance companies do to slow down TPD claims?

Permanent disability TPD insurance companies are sometimes more interested in protecting their bottom line than approving your case. They will look for every reason to minimise, delay, or reject your claim. Of course, some insurers are more cooperative, while others have a track record of prolonging an outcome.

According to the Insurance Contracts Act 1984, Australian insurance companies have a legally obligated to act in good faith. Under section 13 of the Act, they are legally responsible for promptly assessing insurance claims. You can read more about their obligations here >

One technique they use is to ask for your evidence piece by piece. If you do not lodge all the required information in your initial submission, they can seek to delay by requesting each document one at a time. They might also request reports they aren’t required to reach an outcome.

How TPD Lawyers Help with a Successful Claim

How do you successfully claim TPD? Keep your claim on track by first seeking legal advice. Having experienced personal injury lawyers manage your case gives you a higher chance of winning a lump sum payment.

Aussie Injury Lawyers has a 99% win rate for TPD claims on a 100% no win no fee basis. This means you pay us nothing until we win your case. Just like you, we want a fast, excellent outcome.

TPD Insurance Claim Lawyers Nearby

With TPD specialists Australia-wide, it’s simple to seek legal advice at a time and place that is convenient for you. Get expert help to claim a TPD benefit by choosing your location now:

TPD Insurance Claims FAQs

A typical TPD payout takes between six and 12 months. Generally, only complex claims and those with a higher lump sum payout take longer.

ASIC data shows that the approval rate for successful TPD claims is slightly above 80%. However, some cases had to go through the dispute process to achieve a lump sum settlement.

You must have an extended period of time off work to show you can’t earn an income before you lodge a TPD claim. TPD policies differ in waiting periods, but most span three and six months.