7 Top Tips to Win Your TPD Claim

What Does TPD Stand For?

TPD stands for Total and Permanent Disability. If a physical or mental injury or illness renders you totally and permanently disabled and stops you from working in your regular occupation (or one for which you have training, education or experience), TPD insurance policies provide a lump sum TPD payout for successful claims.

How you acquired your medical condition is of no consequence, unlike claims under personal injury law like workers’ compensation or motor vehicle accidents.

How to Make a TPD Claim

Have you ever had to make a TPD claim? If so, you will know how challenging it can be to negotiate a winning TPD payout with a superannuation fund and insurer. Trying to get a disability insurance company to pay up can be impossible.

But don’t give up! You can do some things to improve your chances of a successful TPD claim. Here are seven crucial steps to claiming your deserved TPD insurance benefits.

1. Do you have TPD insurance coverage?

Many Aussies are unaware they have total and permanent disability (TPD) insurance. This is a type of coverage for those who suffer from a life-changing or disabling injury or medical condition that stops them from working. People regularly contact our law firm regarding another type of claim, and we do a free case evaluation with them. After some investigation, a specialist TPD lawyer provides the good news: you have TPD cover, and can open a second legal matter on their behalf.

TPD insurance is usually included in your superannuation policy, and you could have been paying premiums for this cover for many years. It is rare that someone sits down and explores all the entitlements of their super fund. Only when they have an unexpected illness or injury do they seek legal advice to understand all the options available for accessing financial support.

Consult a Specialist TPD Lawyer

If you’re unsure whether you have a TPD insurance policy, it might be time to consult an experienced TPD lawyer. They will help you understand your legal rights and the steps needed to file a claim. Remember, the faster you act, the better your chance of receiving the TPD benefits you deserve.

Get a free TPD claim assessment now by Calling 1300 873 252

2. How do i know if I can make a TPD Claim?

If you have the following, you may be eligible to make a TPD Claim:

- I have been off work for three or more months due to an injury, illness, or mental health condition

- I have, or my employer has contributed to a Superannuation fund (now or in the past)

- I don’t expect to return to work anytime soon or ever

If you think you might have a claim, one of your friendly TPD Lawyers will check your Superannuation funds and let you know if you have one or more claims and what they may be worth. Find out now >

3. TPD Insurance covers mental and physical injury or illness

If a person can return to a job for which they are reasonably qualified, that determines whether their disability is total and permanent. It doesn’t matter if the disability results from a physical or mental injury, illness, or a combination thereof.

For instance, if someone were working as a forklift driver in Sydney and had a TPD policy but began suffering from a mental illness that wasn’t work-related, he might still qualify for TPD.

If he could show that his condition would prevent him from returning to any job for which he is reasonably qualified, the medical condition that prevents you from working does not need to be related to your work. Someone in this situation would be eligible to claim their full TPD policy benefits.

4. What injuries and illnesses are eligible for a TPD Insurance Claim?

Below are some injuries and illnesses that qualify for successful TPD claims. Please understand that this is only an example. generally, any type of illness or injury that prevents you from working is eligible for TPD claims.

- Loss of a Limb

- Lost Sight

- Lost Hearing

- Severe back injuries

- Motor vehicle accident injuries

- Full or partial paralysis

- Major burns

- Multiple types of Cancer

- Alzheimer’s

- Parkinson’s

- Major organ transplants

- Dementia

- Chronic Lung Conditions

- Severe Arthritis

- Chronic Heart Disease

Common psychological illnesses and disorders for TPD claims include:

- Bipolar Disorder

- Anxiety

- Depression

- PTSD

- Schizophrenia

5. TPD assessment is all or nothing

When assessed for Total and Permanent Disability, you are either eligible or not. Meaning that your physical or mental condition either qualifies you as totally and permanently disabled or it doesn’t. If you are eligible, you can access your full lump sum TPD benefit (once approved). If you don’t qualify, you get nothing. Being close to the definition of TPD does not help your situation.

The difference between satisfying the description or not can sometimes be minor and easily missed. To successfully claim TPD, working with an experienced TPD lawyer is vital. Morevover, a typical TPD payout is a five-figure sum, so it is well worth pursuing.

Generally, you only get one opportunity to make a TPD claim, so be sure you present your best legal case. Contact our friendly legal team for your free TPD claims assessment. Call 1300 873 252

6. Do I need to prove fault?

At Aussie Injury Lawyers, it is common for people to think there needs to be some fault on the part of another person when considering injury or compensation claims. Thankfully, this is not the case for successful TPD claims. Generally, there is no requirement to prove the fault of another party when claiming TPD insurance benefits. To win, the primary requirement is to demonstrate that you are totally and permanently disabled as per your insurance policy’s definition.

You may have been injured because of another party’s full or partial negligence, and your injury makes you TPD. If this is your situation, you might have two legal claims. In this case, you will need legal support from a qualified superannuation insurance lawyer to help claim TPD benefits.

7. Your usual occupation and qualifications are important

The question that needs to be resolved when determining if an employee has a total permanent disability (TPD) claim is whether the person is fit to perform their job or whether they can perform any job for which they are reasonably qualified.

You should consult an experienced insurance lawyer to help assess your eligibility according to the provisions of your TPD insurance policy. For example, your insurance policy might have an “own” or “any” job clause. If you have the “any” clause in your policy, you must show you cannot do any job you are suited for according to your training, education, or experience.

The more straightforward definition to prove is “own” occupation. In this situation, you show you cannot do your regular job. Your “own” occupation is the one you did before you were injured or acquired your illness.

This means the last job before ceasing work is critical to a successful claim. For example, if you were working as a baggage handler at the airport and you suffered a physical injury, it is far easier to establish TPD than if you were sitting behind a desk in an office job.

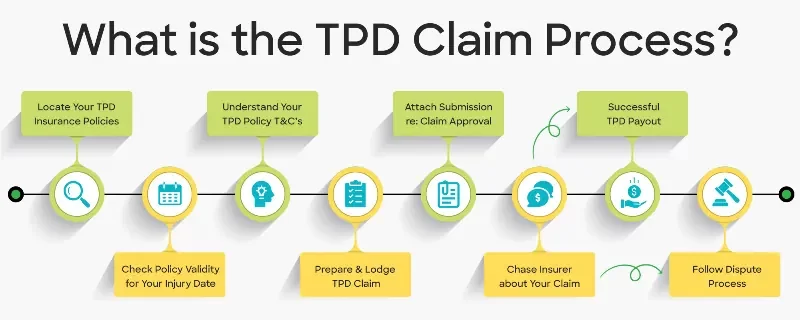

TPD Claim Process: How to Make a Successful TPD Claim

The TPD insurance claim process for successful TPD claims can vary depending on the insurer, but in Australia, it generally follows these seven steps:

- Contact specialist superannuation lawyers

- Locate your TPD policies

- Contact super fund and insurance company

- Collect evidence

- Lodge your claim forms

- Claim approved or dispute rejection

- TPD lump sum payment

It’s difficult to make a TPD claim successfully, and you generally only get one shot, so make sure it’s your best. Contact an expert super TPD lawyer for free legal advice on your best strategy for a winning outcome. Aussie Injury Lawyers is a 100% no win, no fee law firm, so you pay no legal fees until you get a TPD payout and zero if you lose.

The next step in winning a permanent disability TPD insurance claim is to locate your TPD insurance cover, which could be in several super funds or a stand-alone policy. Some fortunate Aussies have multiple TPD policies, which means they can make multiple TPD claims for the same disability.

The next step is to contact your superannuation fund, which may require completing several forms. Then, the super fund will forward your TPD claim to the insurance company for an assessment following an initial evaluation. After this assessment, the insurer will decide whether to accept or reject your claim.

Winning your TPD insurance benefit relies on compelling medical evidence that proves how your illness or injury disrupts your work capacity. This process seeks to satisfy the insurance policy TPD definition, which is crucial for success.

Typically, the medical evidence includes workers’ compensation files, medical records and reports from a specialist doctor confirming your total and permanent disability.

Once your evidence is ready, the next step in the TPD claims process is to accurately and honestly complete and lodge the claim forms. Most insurers also require an attached letter that explains why your claims should be accepted. Winning your claim also depends on this letter and the accuracy of your submission.

Understand that insurance companies often seek to delay settlement by sending numerous separate claim information requests, so a compelling first submission generally results in a faster payout.

TPD compensation will be approved when you have an accepted claim. Conversely, you can have a specialist TPD lawyer or solicitor challenge a rejected or disputed claim.

When you successfully claim TPD, you receive a settlement that helps pay living costs and medical expenses. TPD payouts are a once-off lump sum payment on top of your superannuation account balance.

How much you receive depends on the insurance arrangements in your fund. However, a typical Australian TPD payout ranges between $50,000 and $500,000, with those with multiple TPD insurance claims generally being paid millions.

Successful TPD Claim Case Studies

Emma had initially lodged a bipolar disorder TPD claim with her superannuation provider, QSuper. Before denying the claim, they took six months to evaluate her case, which caused her a great deal of emotional pain. Next, Emma filed an appeal with the Australian Financial Complaints Authority, which was also unsuccessful.

After that, our experienced TPD lawyers handled her matter (with 100% no win, no fee funding) and set up an independent medical examination. This medical report formed the basis of a formal complaint to the insurance company, which reversed its decision, and Emma received a lump sum settlement of her TPD claim of $500,000.

Jim, a Tasmanian school teacher, observed the tragic jumping castle disaster that occurred on December 16, 2021, and as a result, he developed PTSD. Consequently, he had difficulty working because he believed his life had been “stolen from him.” Jim signed an agreement with the Aussie Injury Lawyer’s insurance litigation legal team in March 2023 and six months later received a TPD benefit of more than $388,000.

Security worker Steve was born with hydrocephalus, a disorder that results in the accumulation of extra fluid in the brain. Sadly, by the time he was 46 years old, his medical condition made it impossible for him to work. Six weeks after Aussie Injury Lawyers prepared and filed his TPD claim in August 2023, he received a settlement of over $230,000.

Get Expert TPD Claims Advice

Every day, Aussies find out that they can claim TPD and receive hundreds of thousands of dollars! You could be one of them. However, claiming TPD benefits is often not a straightforward process.

So, if you are considering making a TPD claim, be certain of a successful outcome by getting expert TPD claims advice for your personal circumstances. Your free TPD claim assessment is just a phone call away.

Call Aussie Injury Lawyers now for a free initial consultation at 1300 873 252.

TPD Insurance Claim FAQs

Typically, proceeds from a total and permanent disability claim don’t impact Centrelink payments, including when receiving a Centrelink disability support pension. Your lump sum payment is initially deposited into a superannuation fund account.

However, it’s best to get reliable financial advice if you are considering withdrawing money, as your choices will likely impact your Centrelink benefits.

In Australia, the average TPD payout for a successful claim ranges between $50,000 and half a million dollars. However, people who are eligible to make multiple TPD insurance claims can receive much more. Our TPD lawyers will investigate if you have the legal right to claim multiple TPD benefits. Call Now – 1800 700 125

According to SuperRatings data, the rate of successful TPD claims in Australia is approximately 71%. Which means about 30% of people lose their case. Generally, the claim process is more straightforward for physical disabilities, as they are visible. On the other hand, mental illness TPD claims are more challenging and, hence, have a higher failure rate.

Thankfully, our TPD lawyers consistently win 99% of insurance claims. Contact Aussie Injury Lawyers now to learn how we can win yours.

Some Australians have multiple TPD policies through a superannuation fund. Often, because they have changed job roles several times and were unaware they had TPD coverage with several insurance companies.

Consequently, these fortunate people could claim multiple TPD payouts for the same physical or psychological disability. Aussie Injury Lawyers will investigate for free and advise on your eligibility. Call Now: 1300 873 252.