When claiming TPD benefits through a superannuation fund, some people ask, “Do I need a lawyer for a TPD claim?”

In brief, no. Although legally, anyone can make a TPD claim without a lawyer; it’s essential to understand that seeking TPD insurance benefits necessitates negotiating with an insurance company and super funds with extensive knowledge of the process, eligibility criteria, and restrictions.

Are you unsure if you need a lawyer to help you make a winning claim? Read on to understand the role of a lawyer in TPD claims and help you decide if hiring a lawyer is the right decision for you.

TPD Claims and the Lawyer’s Role

TPD claims involve seeking a TPD benefit payout when a total and permanent disability (due to an illness or injury) prevents you from working again. Typically, these claims are made through superannuation fund insurance cover and, when approved, provide a lump sum payment to cover medical bills, living expenses, and other costs associated with your permanent disability.

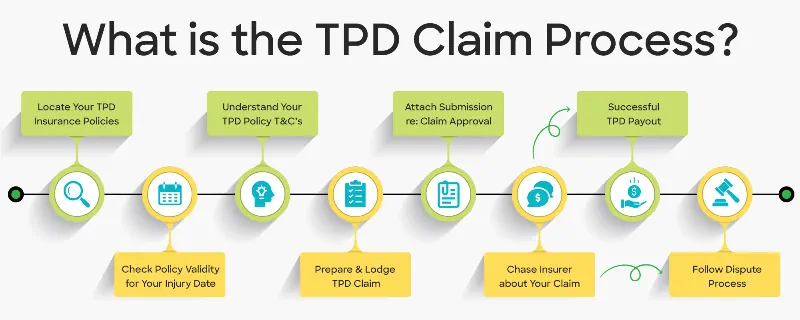

To start the claim process, you lodge a permanent disability claim with your superannuation provider, which will then assess your eligibility for a TPD insurance benefit. Navigating through TPD insurance claims can be complex, but understanding the process is crucial for a successful outcome.

In Australia, insurance companies employ insurance assessors and legal teams whose role is to reduce their liability for TPD payments. Typically, they will scrutinise every aspect of your case to find a reason to deny your entitlements. Experienced TPD lawyers regularly negotiate with all the leading permanent disability insurance providers and understand the techniques they use to reject and delay claims. Hence, your best chance of winning a TPD benefit is to work with an expert legal team with a 99% claim success rate, like the lawyers at Aussie Injury Lawyers.

Defining TPD Claims

TPD is an abbreviation for total and permanent disability. TPD claims involves process of seeking a total permanent disability payout from an insurance policy when the insured person can no longer work in their regular occupation.

Claim eligibility varies depending on the TPD cover, and exclusions may exist. This type of insurance claim is often made through a superannuation account, which could have other specific requirements and exclusions.

The value of a benefit payout depends on the TPD policy and the supporting evidence provided, like medical records and employment history. When successful, lump-sum payouts can range from $50,000 to $500,000, covering various medical costs. Understanding the differences between superannuation funds is essential to making an informed decision.

Why You Need Experienced TPD Lawyers

Legal representation significantly simplifies the TPD claim process. Generally, insurance lawyers help with the following:

- Understand complex insurance policies

- Manage paperwork

- Protect your legal rights during the process

- Ensure you have compelling medical evidence necessary to support claim approval

- Anticipate and remove any barriers to success

- Safeguard you from possible mistreatment by the super fund or insurer.

In some cases, a lawyer is essential to protecting your rights. For example, when an insurance company denies a TPD insurance claim due to non-disclosure or because of a pre-existing illness.

Navigating the TPD Claims Process with a Lawyer

A lawyer provides expert support throughout the TPD claims process. They cover you, from claim preparation to communication with insurers and challenging denied claims. Experienced TPD lawyers will ensure that you submit all required information with an accurately prepared submission, thus increasing the likelihood of a successful claim.

Claim Preparation

A successful outcome relies on diligent claim preparation. In most cases, you have one chance to get it right, so you want to be sure it is your best submission. Preparing a TPD claim involves collating all relevant information, including your medical history, employment records, and medical assessments that satisfy your TPD definition.

A lawyer can assist in ensuring that all the required information is provided and the application is submitted correctly. This includes interpreting policy requirements and constructing a robust claim that maximizes your chances of a successful outcome.

Communicating with Insurers

Communication with insurance companies can be complex and overwhelming due to the process, paperwork, and legal terminology involved. A lawyer can manage these interactions on your behalf, ensuring that communication is conducted correctly and promptly.

A lawyer assists with letter writing, phone calls, and legal paperwork, helping you understand complex jargon and giving advice on the most compelling presentation of your case.

Challenging Denied Claims

If you have a denied TPD claim, a lawyer will advise on the best course of action and help challenge the decision. The appeals process typically entails submitting an appeal to the insurance company, providing additional proof to support your claim, and further negotiation.

How Much Does It Cost to Hire a TPD Lawyer?

There are costs associated with hiring a TPD lawyer, but some provide no-win, no-fee agreements to reduce the financial burden. Generally, what you pay for legal services varies depending on the complexity of the case and the lawyer’s experience level.

The next section will cover different costs and payment options for hiring TPD lawyers.

How much does it cost to hire TPD lawyers? >

Legal Fees and Disbursements

Legal fees and expenses vary based on the lawyer’s experience and the case’s complexity. Some lawyers may charge a flat fee, an hourly rate, or work on a no-win, no-fee basis. When considering legal costs, please understand that:

- The law firm’s work is charged as fees

- Expenses or costs, are the price for medical assessment and reports (also called disbursements)

Aussie Injury Lawyers charge for insurance claims based on the hours of work required to win your case. People choose AIL for TPD claims because we:

- Give you an upfront, capped, or fixed price for your case.

- Let you know your estimated payout value

- We fund your disbursement expenses. But if you lose, we pay those costs.

100% No-Win, No-Fee Policy

Typically, you pay when you win when an insurance claim is run on a no win no fee basis. However, not all no-pay law firms are the same. The difference lies in how they treat disbursement costs. There are generally three main types of no win, no pay funding.

- They will ask you to agree to a high-interest disbursement loan

- You pay for these expenses

- The law firm covers these costs and will not ask for payment if you lose – this is 100% no win no fee.

Choosing Aussie Injury Lawyers means eliminating all financial risk because you owe us nothing if you lose. We can do this because we rarely lose a case thanks to our 99% success rate.

Why choose AIL for your claim >

What to Consider When Choosing TPD Lawyers

When choosing your best TPD lawyers, you must consider factors like experience, communication skills, and how they charge for their work. Lawyers who specialise in TPD insurance claims with a winning track record will greatly increase your chance of a successful claim.

Experience and Expertise

The accomplishments of a lawyer are significant because they show a track record of success in handling TPD claims. Knowing they can handle your claim quickly and competently will give you peace of mind.

Selecting our legal team means working with a combined insurance litigation experience of over 100 years, backed up by our 99% success rate.

Reliable Communication and Support

A TPD lawyer’s support and open lines of communication are essential throughout the claim-processing procedure. You can expect the following from our TPD lawyers:

- Timely communication

- Updates on the status of your case

- Addressing any queries you may have

- Providing direction on your next steps

For a successful TPD claim, you need effective communication and timely updates, keeping you informed about progress and promptly addressing any issues you may have.

When a Lawyer is Essential for TPD Claims

- A lawyer becomes indispensable for a successful TPD claim in scenarios like

- Your TPD claim has been denied or rejected.

- You are unsure if you have a viable case

- Your total and permanent disability is based on a psychological injury. These claims have a higher rejection rate.

- The case has a higher level of complexity, i.e., it is not straightforward.

- You do not want to negotiate with a large TPD insurance company that understands the legal process much better than you.

Hiring a lawyer for your TPD claims can help ensure that you receive the compensation you deserve in these challenging situations.

Legal Advice for Total and Permanent Disability Claims

When it comes to having a winning total permanent disability super claim, it is essential to have a properly prepared claim that accurately addresses the terms of your TPD insurance policy. Doing this dramatically increases the likelihood of a winning outcome in a shorter timeframe.

When you hire AIL for your TPD insurance claim, our team will work hard to understand your personal circumstances, superannuation policies, and T&Cs so they can have your claim accepted on the first submission.

Give yourself your best chance of successfully accessing TPD compensation by contacting Aussie Injury Lawyers now for your free, comprehensive claim investigation – Call 1300 873 252

Frequently Asked Questions

Can I make more than one TPD claim?

Some fortunate Aussies have contributed to multiple superannuation funds during their career. In this case, you may have multiple TPD insurance policies and claims against each for the same total and permanent disability. Furthermore, you could still have live TPD cover even if you haven’t contributed to a super fund for many years. It’s free for Aussie Injury Lawyers to investigate your insurance cover and how much you could get for a TPD payment.

Why are TPD claims rejected?

The most common reason for TPD claim rejection is when the insurer believes you do not meet the TPD definition outlined in your policy terms. Typically, they decide you have insufficient evidence supporting your injury or illness or that you can still work.

What are the eligibility requirements to claim TPD?

- To be eligible for TPD benefits, you must meet certain criteria, such as

- Living with a disabling physical or psychological injury

- Having current insurance cover

- Meeting the work history requirements

- Demonstrating difficulty with daily activities

- Requiring ongoing medical care.

Is it hard to get a TPD payment?

Generally, insurance companies do not enjoy paying large amounts of money, so it can be difficult to claim a lump sum TPD payment. In fact, many Australians find it such a challenging experience that they give up trying to meet their insurer’s demands. Conversely, most Australians with effective legal representation have a claim success rate of over 70%.

What is the average TPD payout?

The average TPD payout in Australia is between $30,000 and $500,000. Some lucky people can make multiple TPD claims worth millions, giving them a comfortable life during their recovery.