Guide to Tax Payable on TPD Lump Sum Payments

Is a TPD Payout Taxable?

Congratulations, your TPD claim has been approved, and you are receiving a payout—a sizeable amount of money paid into your superannuation account from an insurance company. Next, you are probably questioning the tax implications:

- Do you have to pay tax on a TPD payout?

- Is tax payable?

- What are the tax rates?

- What is my eligible service date?

- How much tax will I pay?

- How do you determine tax liability?

Thankfully, when you have a successful claim, your TPD insurance payout is generally not considered taxable income and is tax-free. Providing you leave this money in your superannuation account until you reach retirement age.

What is a TPD Payout?

According to the Income Tax Assessment Act 1997 (ITAA 1997) a TPD lump sum payout is:

(a) An insurance benefit paid to someone suffering from ill-health, either physical or mental, and

(b) Two legally qualified medical practitioners have certified that the person’s illness or injury makes it unlikely that they will ever be able to be employed in a job for which they are qualified because of their education, experience, or training.

Tax on TPD Payment in a Superannuation Fund

You must pay tax if you are below your superannuation preservation age (which depends on when you were born) and withdraw funds from your TPD payout.

When you withdraw TPD funds from your superannuation, your superannuation provider will issue you a PAYG summary to the Australian Tax Office, which has already deducted tax.

They will tax you at the top rate, and you can get some of this back on your annual tax return. For instance, if you have no job or other income, you will likely get some of this tax back at the end of the year.

What is the TPD Tax Rate?

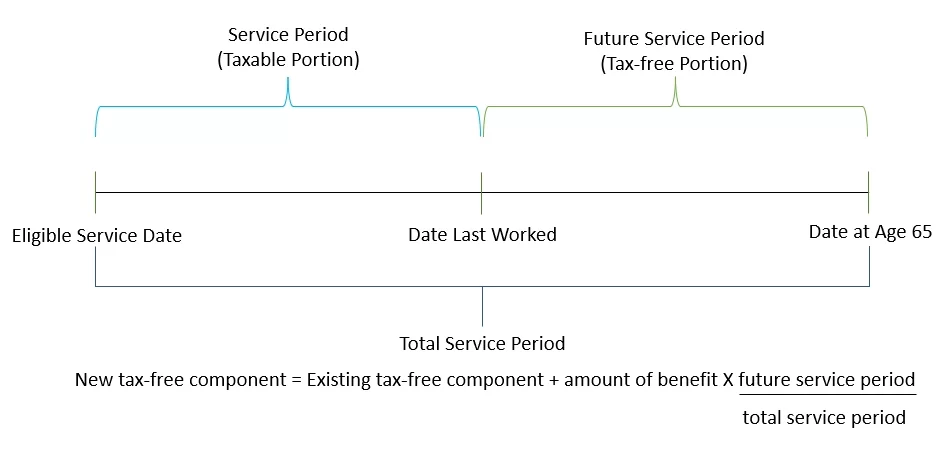

- Your TPD claim benefit will usually be taxed at 22% (which is the taxable portion). But, there will be an existing tax-free portion because your superannuation provider will do a tax-free uplift calculation.

- When you withdraw permanent disability TPD funds from a superannuation account or roll over to another superannuation fund, this is a new tax-free component calculation.

- Every Australian with a successful TPD payment will be taxed at a special rate ranging between 18% and 1%. Each can be taxed at varying rates if you have multiple super accounts and multiple TPD claims.

3 Factors for the TPD Tax-Free Uplift Calculation

When withdrawing TPD money below the preservation age, you can be eligible for a tax-free uplift. Three taxable components are used to make this calculation.

- Date of birth

- Eligible service date: This is the date your superannuation account started. If you combine multiple superannuation accounts into one, the earlier eligible service date is used for calculations.

- Date last worked: This was when you ceased working due to your total and permanent disability. In most cases, it is not the date you acquired your medical condition but your job cessation date.

Basically, the time between when your super account began (the earlier start date) and your date of last work is the taxable component and is taxed at 22%. The time between your date of previous work and your preservation age is tax-free.

Please know that superannuation funds do not always calculate taxes correctly. So, it would be a good idea to speak with an experienced accountant or tax agent to confirm your tax commitment.

Typical TPD Taxable Income Calculation Errors

Many people withdrawing TPD funds are overtaxed because the incorrect time is used as the last worked date. Sometimes, superannuation funds use the date they did your calculation or the time your claim was accepted. In this situation, you can pay too much tax because they are using a later date than when you ceased working.

What To Do If You Are Overtaxed

If the super fund takes too much tax, you can claim it back at the end of the financial year, but this isn’t always the case.

Your super fund sent incorrect information to the ATO, so they must rectify the error. You should ask them for an explanation of how they calculated your tax.

What are the Lump Sum Superannuation Withdrawal Rules?

Generally, you can access the funds in your super account once you have met a condition of release, like reaching your preservation age or retirement. Once approved, you can choose to:

- Withdraw a lump sum amount

- Make a partial withdrawal

- Roll over your super balance to begin an income stream.

What is the Superannuation Preservation Age?

If you are in an older age bracket, you may wish to delay withdrawing your TPD payout. In this case, you can take out $210,000 tax-free from your superannuation account once you have passed your preservation age. For people older than 60, all superannuation withdrawals are tax-free.

Date of Birth | Preservation Age |

Before 1 July 1960 | 55 |

1 July 1960 – 30 June 1961 | 56 |

1 July 1961 – 30 June 1962 | 57 |

1 July 1962 – 30 June 1962 | 58 |

1 July 1963 – 30 June 1963 | 59 |

From 1 July 1964 | 60 |

How to Reduce Your TPD Tax

Before withdrawing your TPD payout, you must understand your financial circumstances and tax obligations. It would be worthwhile speaking with a tax professional. Understanding the tax treatment for TPD benefits by the Australian Tax Office could save you thousands of dollars.

Summary of TPD Tax Obligations and Tax Free Uplift

Here is a simple breakdown of how tax applies to TPD payouts.

- If you are 60 or older, your TPD payout is tax-free.

- Below 60 years old, your tax commitment depends on your eligible service date, which is usually the date you joined your super fund.

- If you are below your preservation age, some of your withdrawals will be tax-free, and the balance is taxed at 22%

- If you are below 60 years old but at your preservation age, withdrawals of $ 225,000 or less are tax-free.

- If you make a lump sum withdrawal over $225,000: some of this money will be tax-free.

How Does a TPD payout impact Centrelink payments?

If you receive social security benefits and are due a successful TPD payout, you will likely want to know how they work together.

When your TPD lump sum payment is approved, your funds will be deposited into your superannuation fund account. Centrelink will disregard your superannuation account balance from their means assessment until you are in the 65.5 to 67-year age range, which is the Centrelink Age Pension period. Other Centrelink benefits will also not be impacted, like child support payments.

If you withdraw some or all of your TPD payout from your superannuation fund account, this situation changes. In this circumstance, Centrelink may consider reassessing your financial situation and adjusting your social security payments.

We recommend you seek professional financial advice for potential strategies before withdrawing your TPD funds from your superannuation account. The Centrelink claim process is typically complex, and you want to be sure you are making the best decision.

Which Income Tax Assessment Act Sections Apply to Tax Paid on TPD Lump Sum Benefits?

The following Australian legislative provisions determine tax payable on TPD benefits:

- Income Tax Assessment Act 1997 section 6-5

- Section 118-30

- section 307-145, particularly subsections 2 and 3

- Section 307-210, 215, 220(1) and 400

- Section 307-215

Tax on TPD Payout FAQs

What is adjusted taxable income?

The total of the following values is known as adjusted taxable income:

- Your annual taxable income (excluding any assessable First home super saver released amount)

- Adjusted fringe benefits total

How do you calculate the eligible service date?

The eligible service date is the earlier date of either:

- Your account opening date with the super fund

- The date you began working that is related to contributions to your super account.

If in doubt, it’s best to contact your super fund to get your service date.

Why is my TPD claim taking so long?

Two significant factors in the time for TPD claim approval are:

- The complexity of the TPD claim

- The size of the payout

Insurance companies often aim to devalue large claims, which results in lengthy negotiations with TPD insurance lawyers. However, you can speed up the TPD claim process by actively pursuing the permanent disability TPD insurance company.