TPD Back Injury Claims: 100% No Win, No Fee Spinal Compensation

Can’t work due to a back injury or spinal damage?

Use our fast and straightforward TPD Payout Calculator now to know the value of your lump sum payment. Understanding how much your TPD claim is worth is a vital first step in deciding to pursue your entitlements. Try our online tool now for a quick estimate, or request a fast claim review by phone at 1300 873 252.

(Disclaimer – Online claim estimates are approximate. For an accurate free evaluation, please email us your details or book a free appointment)

Help us calculate the value of your claim by answering these questions. You can also call us anytime on 1300 873 252 for a free estimate of your claim.

Our fast and easy TPD Calculator is here to help you understand the value of your lump sum payment. With a few clicks of the mouse, you can enter your information and receive a payout estimate quickly. This TPD payout calculator is ideal for those considering making a claim or wanting to know how much they may be entitled to when they have a successful TPD claim.

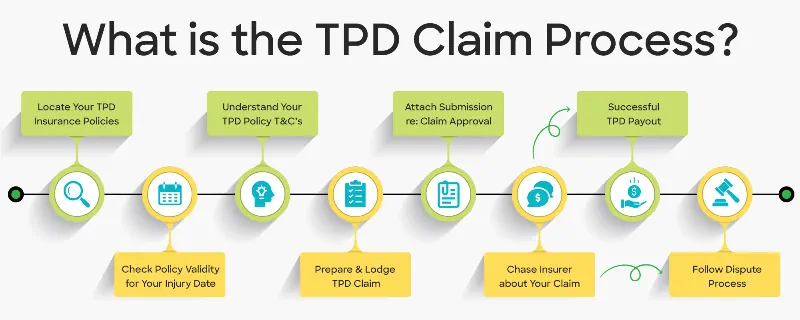

Alternatively, to learn about your eligibility for a lump sum payout and the TPD claim process, please contact our TPD Experts for your complimentary case review. Our team of insurance claim lawyers will:

To receive your TPD payout calculation, please call 1300 873 252, or use our online calculation tool now.

TPD payouts are based on the level of insurance cover held in your superannuation fund, the terms of your policy, and Australian tax rules. Our online TPD Payout Calculator gives you a fast estimate by using the basic details you provide.

Our estimate is only a guide, the exact calculation requires a review of your superannuation accounts, policy wording, and medical evidence. For an accurate figure, our TPD claim lawyers can complete a complimentary case review and confirm the value of your lump sum entitlement.

How much you get for a TPD claims payout in Australia varies depending on your circumstances and whether you are eligible for one or multiple claims. Obtaining information on the average benefit payout for TPD claims can be challenging due to its confidentiality. However, we know that in Australia, there are more than 150,000 successful total and permanent disability claims, with the disability insurance payout deposited into the claimant’s superannuation account. (Where you can withdraw the funds)

The average TPD payout in Australia is around $150,000. The claim amount can vary significantly, ranging from $60,000 to $2,000,000, based on the disability insurance coverage and policy terms. Some fortunate people who contributed to multiple superannuation funds during their working lives may be eligible for multiple TPD claims.

When selecting Aussie Injury Lawyers to manage your TPD insurance claim, you can be assured that you are choosing an Australian law firm experienced in superannuation and insurance law, with a strong track record for successful TPD payouts.

Our legal team knows how to make a successful TPD claim backed up by our 99% success rate. When AIL accepts your case on a 100% no-win, no-fee basis, you have a strong chance of getting your desired outcome.

Aussie Injury Lawyers provide all Australians with TPD Claim Payout legal services with 100% No Win, No Fee, No Risk legal financing. Signing our easy-to-understand legal cost agreement means you:

Not all no-win, no-fee insurance claim law firms are the same. Some ask you to agree to a disbursement loan with a high interest rate. Aussie Injury Lawyers is different. Our No Risk policy states that we cover disbursement costs, even in the case of a loss, to ensure no financial risk for our clients.

Feel confident with the knowledge:

√ We don’t charge success or uplift fees.

√ Our legal costs are calculated based on the work hours we need to win your claim (not a percentage of your lump sum payout)

We understand it will be challenging to maintain your finances when you can’t work because of an illness, injury, accident or psychological disorder.

Rely on Aussie Injury Lawyer’s expertise and streamlined claim processes to fast-track your Superannuation TPD Claim approval. We aim to get you back to your everyday life quickly. Please find out how we do it by calling 1300 873 252.

Once you have an approved permanent disability tpd claim and know the value of your TPD payout, you will need to consider the tax calculations used by the Australian Tax Office. Doing this will help you maximise your TPD benefits.

You will be pleased to learn that TPD insurance claims paid through Super are generally not considered taxable income when the funds remain in your super fund account until you reach preservation age. However, if you withdraw funds before retiring, you will pay tax.

The good news is that you could be eligible for a tax-free component (known as tax free uplift) when withdrawing TPD funds from an active superannuation policy before retiring. This component lowers the effective withdrawal tax rate and considers three factors.

NOTE: In Australia, superannuation funds sometimes make tax calculation errors. If you are considering withdrawing from your permanent disability TPD payout, please seek advice from a qualified tax agent or accountant.

Aussie Injury Lawyers is well-known for their expertise in superannuation insurance TPD claims in Australia. We have helped thousands of people access TPD compensation through their superannuation fund. As an AIL client, you will receive regular updates and continuous legal support as we strive to achieve your desired outcome.

Our 99% success rate, combined with many years of legal experience, guarantees your well-deserved payout. Join the many everyday Aussies who choose AIL to successfully claim all their TPD insurance benefits. Call Now: 1300 873 252.

When your TPD insurance claim is approved, a lump sum payout is made to your superannuation account. What you do next will impact the tax calculation that applies to those funds, including the tax-free component.

So it’s best to speak with a financial advisor about the tax implications before making a TPD withdrawal from a super account.

Yes you can make multiple TPD claim through multiple superannuation funds when you have several TPD insurance policies. To have more than one payout, you must meet the total and permanent disability definition of each active superannuation policy. Our TPD lawyers will explain how it works when you call us for your free claim investigation.

It can be hard to get a TPD payout if you don’t have strong proof that meets the TPD definition in your super fund insurance policy.

Sadly, insurance companies want people to give up so they don’t have to pay a settlement. Experienced insurance claim lawyers know how it works, so they will help you have a successful outcome.

In some circumstances, depending on the terms and conditions of your TPD cover, you can return to paid employment after receiving TPD compensation. If you are eligible, you will not be able to work again in your usual occupation. Instead, you would need to train to work in a different occupation suited to your total and permanent disability.

Yes, your TPD payout can affect Centrelink payments depending on how you access it. If your TPD insurance payout stays in your superannuation account, it usually won’t impact your benefits. But if you withdraw your lump sum payment, Centrelink may apply income and assets tests, which could reduce or stop benefits like the Disability Support Pension. To understand how your payout may affect you, contact our team for advice.

On average, most TPD claims are finalised within 3 to 6 months. Some are resolved faster if the insurer accepts your medical evidence, while others can take longer if extra reports are needed. Using our TPD Calculator gives you a quick estimate of your lump sum payout while you wait. Having our expert TPD lawyers manage the claim also helps speed up the process.

Can’t work due to a back injury or spinal damage?

The most common types of successful TPD claims are cancer,

A successful TPD Payout can range between $30,000 and $500,000,