- 100% No Win No Fee

- 99% Win Rate

- Capped or Fixed Prices

- 24 Hour Payouts

- We Cover Outlays

How to Claim TPD Insurance Through Super

In Australia, when you can’t work again in your usual occupation because of an injury or illness, you can make a total and permanent disability (TPD) claim through your superannuation fund. Generally, any medical condition that stops you from working can qualify as TPD, regardless of whether you have a mental illness, an unexpected illness or injury.

Our ultimate guide covers every aspect of TPD claim requirements for successful superannuation TPD insurance claims, helping you secure your financial future during tough times.

It’s free to know if you can claim: Call 1300 873 252

About TPD Claims Through Superannuation Funds

TPD cover is designed to provide financial support through a lump sum payment, known as a TPD benefit, for Australians who can’t work due to an injury or illness. Many workers don’t realise they have TPD insurance cover included in their superannuation fund. You can access this valuable insurance benefit when you can’t earn an income.

But how do you know the eligibility criteria for a TPD superannuation claim, and how do you work through the often-complex TPD claims process? We will explore the fundamentals of making a TPD claim and how they interact with your superannuation.

What is Permanent Disability TPD Insurance?

In Australia, TPD insurance pays a lump sum amount when you meet the definition of being ‘totally and permanently disabled’. As a result, you may have a successful TPD claim if an illness or injury prevents you from working in your primary occupation or any other employment for which you are qualified due to your education, training, or experience. And it’s not just for physical injuries. Mental health conditions and psychological illnesses that disrupt your work capacity also qualify for a TPD claim.

Once approved, TPD insurance benefits are typically paid as a one-time lump sum payment that helps replace lost income and helps cover living and medical expenses.

About TPD Coverage Definitions

Every insurance company and super fund insurer has a different definition of total and permanent disability, but three main categories generally exist.

- Own occupation: You can’t work again in the role you were doing before your disability. This TPD coverage typically costs more and is unavailable through a superannuation provider.

- Any occupation: You can’t work again in any role suited to your training, education, or experience. This cover is usually cheaper but more complicated to claim.

- Activities of daily living: This definition is not based on your job. Rather, it assesses your capacity to care for yourself and lead an independent life.

Each category has distinct criteria; therefore, grasping your insurance policy’s specific TPD definition and satisfying these criteria is the key to winning a TPD insurance benefit.

TPD Claim Requirements to Make a TPD Claim

TPD cover is designed to provide financial support through a lump sum payment, known as a TPD benefit, for Australians who can’t work due to an injury or illness. Many workers are unaware that their superannuation fund includes TPD insurance cover, which can be claimed if they are unable to earn an income.

Thankfully, our specialist superannuation lawyers will investigate permanent disability insurance claims for free and help you know your options (including if you can make multiple TPD claims) Call Now – 1300 873 252

How To Make a Successful TPD Claim

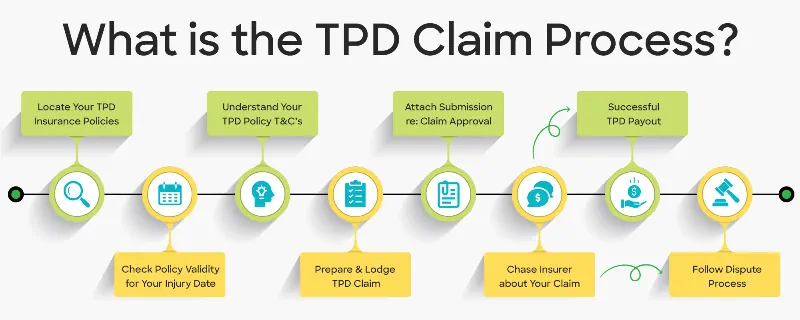

Many Australians question, “How does a TPD claim work?” To start the TPD claim process, you’ll need to follow these steps:

- Locate all your super insurance TPD policies and check the eligibility clauses.

- Verify if they were current at the time of your illness or injury

- Contact the superannuation fund and request the relevant TPD claim form.

- Fill out the forms with information about your medical condition, employment history, and other relevant details. Provide honest, accurate, and thorough details, as errors or omissions could delay your case or cause a claim denial.

- Attach a supporting letter explaining why you should have an approved insurance claim.

- Actively pursue the insurer to confirm they have all the information required to make a decision.

- Contact a TPD lawyer for help with the dispute process if your claim is denied.

Can I Make Multiple TPD Claims?

You can make multiple TPD insurance claims when you have insurance with multiple super funds. Some fortunate Aussies have contributed to more than one superannuation account and, hence, have multiple disability policies. In this case, you can lodge separate claims against each superannuation insurance policy for the same permanent disability. These funds will help pay your medical and rehabilitation costs.

Please be aware that each insurer’s terms and conditions will differ, including their Total and Permanent Disability definitions. Winning each separate claim depends on meeting the requirements of each insurance company. For this reason, the support of an experienced TPD lawyer will likely provide the best chance of a winning outcome.

Know if you can make multiple claims and their value by calling 1300 873 252

Assessing Your Policy’s TPD Definition

Before making a TPD claim, it’s crucial to understand the TPD definition in your insurance policy, as it determines your eligibility for a disability payout. This definition varies among policies.

- Some cover you if you can’t return to your pre-injury occupation

- Others cover you if you’re unable to perform any kind of work.

Recognising these differences will help you create the necessary supporting information and evidence to support your claim.

Reasonable Retraining

The “retraining clause” is another crucial aspect of the TPD definition. Under the TPD definition of most Australian superannuation funds, you must be unable to find employment in your usual (or any) occupation for which you are reasonably qualified by experience, education, or training, allowing for the restrictions caused by your injury or illness.

The reasonable retaining clause states that even if you receive reasonable retraining that takes your disability into account, you still won’t be able to return to work. For this reason, insurance companies will ask for detailed information about your current job description, work history, and past vocational training.

Is it Hard to Get a TPD Payout?

The success rate of TPD claims can vary, with around 82% of claims being approved in Australia, according to some sources. When claiming Total and Permanent Disability (TPD) through your superannuation provider, you must prove that you have a long-term disability, which differs from establishing a permanent disability for NDIS or Centrelink benefits.

• Typically, the superannuation trustee communicates with the insurance company and confirms a satisfactory resolution.

• If the trustee disagrees with a decision, they should assist in resolving the dispute.

• However, there are significant differences in the behaviour of superannuation trustees, which is why a skilled TPD litigation lawyer can help get the best outcome.

3 Common Challenges for Successful TPD Claims

There are three common challenges to a successful TPD insurance claim:

- Not satisfying the TPD definition for your TPD insurance coverage.

- A common reason for TPD claim rejection is insufficient medical evidence or inconsistent medical reports.

- Claiming TPD benefits can be challenging due to the complexity and frequency of rejected claims.

TPD Claims Process Timeline

Super TPD Claim Process

It can be challenging to make a TPD claim successfully, but with expert legal support to understand TPD claim requirements, it can be less stressful. Here is the step-by-step TPD claims process for winning insurance benefits:

1. Notify the insurer

The first step in lodging a TPD claim involves notifying the insurer and preparing comprehensive documentation.

2. Consult With a TPD Lawyer

Hiring a TPD lawyer can significantly improve your chances of a successful claim. That’s because specialist TPD lawyers have substantial expertise when:

- Locating old superannuation funds & insurance policies

- Checking for TPD coverage

- Negotiating settlements with large insurers

- Championing your rights if you have a rejected claim

Remember, when selecting TPD lawyers, discuss legal fees before proceeding so there are no nasty surprises. Aussie Injury Lawyers operate on a 100% No Win, No Fee basis. Pay legal fees when you win, and nothing if you lose. Plus, we will give you an upfront, capped, or fixed price before we start work on your case.. Get a quote now >

3. Collate Medical Evidence

Proving TPD claims requires compelling medical evidence documenting how your injury or illness impacts your work capacity. This evidence typically includes medical assessments showing how your illness or injury satisfies your insurance policy’s terms, particularly for mental illness TPD claims.

4. Lodge Your TPD Claim

After submitting your claim forms, your superannuation fund will review your documentation to decide if you qualify for a TPD payment. This process can take several months, so you should follow up with your super fund to make sure they have all the necessary information.

Additionally, your insurance company will typically request additional information during the claims process to make a decision.

5. Lump Sum Payout or Denied TPD Claim

Once approved, a lump-sum payout is deposited into your superannuation account. The decision to withdraw, transfer, or postpone withdrawal is then yours. If you have a denied claim, your lawyer can challenge the insurer’s decision using the internal dispute resolution process or start court proceedings if necessary.

Common Types of TPD Claims

You can make a total and permanent disability claim for many medical concerns. Generally, any physical injury, illness, or psychological disorder that prevents you from performing your regular job can qualify for a successful Total and Permanent Disability (TPD) insurance claim. Below are some of the most common kinds of TPD claims in Australia.

| Some physical injuries that qualify for TPD | Chronic back pain Spinal cord injuries Head and brain trauma Loss of Vision, Hearing or Speech Shoulder injuries Lower limb damage Loss of limb Paraplegia and Quadriplegia Injury from a motor vehicle accident |

| Mental health conditions qualifying for mental illness TPD claims | Depression Anxiety PTSD Schizophrenia Bipolar Disorder Borderline Personality Disorder Any other recognised and diagnosable psychological disorder |

| Some illnesses and diseases that qualify for TPD | Most Types of Cancer Multiple Sclerosis Dementia Motor Neurone Disease Muscular Dystrophy Alzheimer’s and Parkinson’s disease Chronic lung conditions Severe Arthritis Heart Attack and Stroke |

Please check your TPD policy terms or contact our friendly insurance experts to find out if you have an eligible claim. It’s free to understand your circumstances.

More about the common types of TPD insurance claims >

Examples of Common TPD Claim Situations

The following are some frequent situations that may result in successful TPD claims.

| Permanent Injury or Illness | When a permanent injury or illness results in an inability to work, you could claim TPD entitlements. This includes physical injuries like: • Limb loss • Spinal injuries, including paralysis • Recognised mental illnesses like depression and anxiety. |

| Work Accidents | When a permanent injury or illness results in an inability to work, you could claim TPD entitlements. This includes physical injuries like: • Limb loss • Spinal injuries, including paralysis • Recognised mental illnesses like depression and anxiety. |

| Serious Illness | When the unexpected happens, and you are seriously injured in a work accident, you may be entitled to make a workers’ compensation claim and receive permanent disability benefits. Typical workplace incidents include: • Slips, trips, falls • Industrial accidents • Work-related illnesses |

| Hospital Isolation | You could claim TPD compensation if you are hospitalised due to a long-term illness or injury that stops you from working. |

| Motor Vehicle Accident | If you are permanently disabled by a motor vehicle accident, you could make a TPD claim and receive a lump sum payment. |

Tips for Maximising TPD Insurance Claims

When seeking to maximise your TPD claim, remember a few essential tips.

- Provide as much evidence as possible to support your case, including your medical records and any other documentation that can help prove your case.

- Be honest and transparent, ensuring your claim is accurate and consistent to increase your chance of receiving compensation benefits.

- Seek professional assistance from a lawyer or TPD specialist. Your legal team will give you the best chance of a successful claim.

- Be patient and persistent. Claiming TPD benefits can be a lengthy process, but with the right approach and mindset, you can get a lump sum payment.

Superannuation TPD Claim Payouts

Once you have an approved claim, a once-off TPD payout will be deposited into your super account on top of your existing balance. But how much will you receive, and how can you access your funds?

What is the average TPD payout?

The amount of money you are entitled to for a TPD payout depends on the value of your superannuation insurance policy. A typical TPD payout in Australia can range significantly between $30,000 and over $500,000. Some fortunate people can make multiple TPD insurance claims worth millions.

What Can Delay a Total and Permanent Disability Payout?

Several factors can delay a permanent disability TPD payment, such as:

• Insufficient medical history

• Failure to provide proper evidence of your disability.

• Inaccurate policy information

• Incomplete paperwork

Accurately presenting the extent of your impairment is critical for a successful claim.

To ensure a quick and fair claim, you must have an experienced disability claim lawyer supporting you. They will guide you through the claims process, significantly improving your chances of receiving a TPD claim payout.

Successful TPD Claim Case Studies

QSuper Denied Claim Reversal

Emma had initially submitted a TPD claim for bipolar disorder with QSuper. This leading Australian super provider had taken six months to assess her case before rejecting the claim, causing significant emotional distress. Emma then had an unsuccessful appeal with the Australian Financial Complaints Authority. Aussie Injury Lawyers then took over her matter (on a 100% no win, no fee basis) and arranged an independent medical examination. Based on these medical reports, we submitted a formal complaint to the insurance provider, had the decision overturned, and Emma received a payout of $500,000.

Successful PTSD TPD Claim

Jim, a school teacher in Tasmania, witnessed the horrific jumping castle accident on 16th December 2021 and suffered PTSD as a result. Consequently, he struggled to work as he felt his life had been “stolen from him”. Jim agreed to work with our skilled compensation legal team in March 2023, and in August, he received TPD compensation of more than $388,000.

Brain Injury TPD Settlement

Steve, a security worker, was born with hydrocephalus, which is a medical condition causing excess fluid buildup in the brain. Sadly, his medical condition meant he could no longer work by the time he was 46 years old. Aussie Injury Lawyers prepared and lodged his claim in August 2023, and six weeks later, he received a payout of over $230,000.

Is a Permanent Disability Claim Payout Taxable Income?

While a TPD payment is generally tax-free, a lump-sum withdrawal from your super fund will have tax implications. However, if you leave funds in your superannuation account until retirement, you will likely pay no tax on your TPD lump sum. Here are some facts about tax on TPD payouts:

- If you withdraw your TPD payout before retirement, these funds are treated as taxable income.

- Superannuation funds may incorrectly calculate the tax-free component of a TPD payout.

- When withdrawn, the tax rate on TPD payouts is usually around 22%. However, if you do make a withdrawal, the super fund will calculate the tax-free uplift, so some of the funds will be tax-free.

- We recommend consulting with an accountant or financial advisor before deciding how to spend your insurance benefit to minimise your tax liability.

Centrelink and Other Government Benefits

A TPD payout generally won’t impact your Centrelink payments if the funds are held within your super. However, if you choose to withdraw, it could affect your Centrelink benefits and other government financial assistance. If this is your situation, please seek expert legal advice to understand the potential impacts on your Centrelink disability support pension or other benefits.

How TPD Lawyers Help Win a TPD Claim

Hiring the best TPD lawyers for your super TPD claim is essential for a winning outcome. That’s because expert compensation lawyers regularly negotiate with insurers to maximise claim outcomes.

• Sadly, many clients abandon their TPD claims when the process becomes too complicated, which a lawyer can help avoid.

• Experienced TPD lawyers help prepare thorough applications that can prevent claim rejections due to incomplete submissions.

• Ensure you have compelling evidence, such as expert reports and medical records

When you choose Aussie Injury Lawyers for your TPD claim, you are accessing more than 100 years of combined insurance litigation experience with a 99% win rate. We have helped thousands of people successfully claim TPD insurance benefits. Furthermore, all our insurance claim legal services have 100% No Win, No Fee legal funding, which means you owe us nothing until we win your case and nothing if you lose. Hence, you are free of financial risk with AIL. Get free advice now by Calling 1300 873 252

Australian TPD Claims FAQs

What are the conditions for a TPD claim?

To have a successful TPD claim payout you must:

- Have at least one valid TPD insurance policy

- Be unable to work in your own (or any) occupation based on your training and experience because of a permanent injury or illness

- Meet the definition of a disability of your policy terms

- Have compelling medical evidence that proves your case

How long does it take for a successful tpd insurance claim?

The total and permanent disability claims process can take three to six months on average, but up to 12 months for more complex claims.

Is there a time limit to claim TPD?

There is generally no time limit to make a TPD claim in Australia. However, sometimes there is an age limit. TPD insurance policies differ in their terms and conditions, so you should check with your superannuation fund to be certain.

How do you successfully claim a TPD insurance benefit?

To successfully claim TPD, you must understand your policy terms, gather medical evidence, accurately complete the form, submit the claim and wait for approval. If accepted, you will receive a lump sum payout that could ease the financial burden of your injury or illness.

How long do you have to be off work to claim TPD?

You typically need to be off work for three to six months before you can make a TPD claim. This ‘waiting period’ will change depending on your policy terms, but once it expires, you can make a claim at any time.

Can I go back to work after a TPD Claim?

You can return to work after a successful TPD claim in specific circumstances, depending on your insurance policy’s terms and conditions and other variables. There are generally two main categories of TPD policy terms:

- You can’t return to work in your own occupation

- You can’t return to work in any occupation

• The first type means you can’t do your regular job but could train to work in a different industry.

• The second type is more difficult because you can’t work in any occupation.

• The one exception is when innovative therapy aids your recovery to the point where you can resume employment, in which case you could return to work and keep your TPD insurance benefit payout.