Guide to the Top 6 Most Common TPD Claims

Common Types of TPD Claims in Australia

This article outlines the common types of TPD claims in Australia, which will help you understand your options if you are permanently disabled.

You likely don’t know your legal entitlements when you have an illness or injury and are unable to work. Although most Australian workers have Total and Permanent Disability (TPD) insurance coverage through their superannuation fund, they are often unaware that they can make a TPD claim, which offers vital financial support when they can’t work.

At Aussie Injury Lawyers, our TPD lawyers let you know if you can make a TPD claim, for free – Call Now 1300 873 252

Common Super Fund Life Insurance Policies

Everyday Aussies typically have multiple super insurance policies that provide financial security, including TPD cover. You probably dislike giving your hard-earned money to insurance companies, but most people understand the necessity of having financial protection.

Permanent Disability TPD Insurance Through Superannuation Funds

Almost all working Australians have contributed money to a superannuation account. If you are one of these, you most likely have several life insurance policies within your superannuation fund. You could have:

- Permanent disability TPD insurance

- Life insurance cover

- Income protection insurance

Total and Permanent Disability Claims

When you cannot work in your usual occupation because of an illness or injury, you could make a total and permanent disability claim. In Australia, many medical conditions, including recognised mental health conditions, qualify for TPD insurance claims. Successful TPD payouts are usually in the form of a lump sum payment, which may be non-taxable income.

Furthermore, some fortunate people can make multiple TPD claims if they have contributed to multiple super funds with associated TPD policies.

Life Insurance Cover

Life insurance is also known as terminal illness, death cover or death claims. When you are receiving medical treatment for a terminal illness, or have passed, you or your loved ones can access a lump sum payout or an income stream.

Income Protection Insurance (TTD)

You could claim income protection insurance when a temporary illness or injury stops you from working. Usually, a TTD payout is 75% of your usual pay and ongoing payments that are distributed as an income stream.

This type of insurance coverage replaces lost income and helps fund your medical treatment expenses and rehabilitation costs.

More about TPD Insurance Claims

Common Examples of TPD Claims

In Australia, a mental illness or other serious injury or illness could totally and permanently disable you. But some common examples of TPD claims include medical conditions caused by:

- Car and work accidents

- Brain and spine injuries

- Terminal illness

- Eyesight and hearing loss

- Chronic illnesses like heart conditions, dementia and Alzheimer’s, liver disease, arthritis, Parkinson’s and more

- Recognised mental health conditions such as PTSD, depression, anxiety disorders, schizophrenia and bipolar disorder.

the Most Common TPD Claims

In Australia, some common illnesses, physical injuries, and psychological disorders qualify for a successful permanent disability claim.

When you make a TPD claim, it is crucial to provide medical evidence that shows you won’t fully recover from your permanent disability. Here are some common TPD claims that qualify for a lump sum payout.

1. Cancer TPD Claim

A wide range of terminal cancers qualify as total and permanent disabilities, which makes them a common type of TPD claim.

If you are a working Australian with a terminal cancer diagnosis, making it hard for you to work and earn a living, you could claim TPD. Generally, you will require extensive treatment, accompanied by considerable medical expenses. Your TPD payout will help you fund your life during this challenging time, allowing you to make the most of your life. Ask an experienced TPD lawyer how it works.

2. Post Traumatic Stress Disorder (PTSD)

Common TPD claims include those for mental health conditions, like PTSD. Post-traumatic stress disorder (PTSD) is a psychiatric illness suffered by people who have lived through a stressful incident like war, violence, sexual assault, a severe accident, a near-death experience or something similar.

Mental illness TPD claims are increasingly common in Australia as insurance companies and employers understand the impacts psychiatric conditions have on the ability of employees to do their jobs. Hence, this condition often qualifies for both workers’ compensation claims and TPD benefits.

3. TPD Claim for Anxiety and Depression

Other common TPD claims include those for mental health conditions like anxiety and depression. Given the impact of these mental health disorders on your ability to work, it should come as no surprise that depression and anxiety are frequent causes of mental illness disability claims.

If you receive a medical diagnosis of anxiety and depression, you may be eligible to lodge a successful TPD claim for a psychological condition. You will need reliable medical reports and evidence to ensure a positive outcome for this kind of claim.

4. Stroke And Heart Attack Claims

If you have a heart event, your ability to work can be severely impaired, giving rise to a TPD or TTD claim, depending on whether your condition is temporary or permanent.

If you have had a heart attack or stroke, your medical professional (GP, surgeon or hospital staff) will assess your capacity to return to work, temporarily or permanently. Since these types of medical incidents happen later in life, claiming TPD benefits and retiring early may be a good choice.

People who suffer a heart attack or stroke and qualify as having a permanent disability can make a TPD claim and receive a lump sum payout. They can also access their super early because they can’t work.

5. Loss of Sight or Hearing TPD Claims

Loss of one of your primary senses, such as hearing or sight, is very distressing. If you have declining vision or hearing, it will impact your capacity to work, depending on the nature of your usual occupation.

To qualify as totally and permanently disabled, you need to be unable to work in your regular job, in most cases, depending on the terms and conditions of your superannuation policy insurance. In this situation, our team of expert TPD lawyers will guide you through the TPD claim process so you can access the money you need to cope with your new living conditions.

6. TPD Claim for Loss of Limb

Losing a limb or a section of a limb is a serious but sometimes necessary decision made to ensure survival. Amputation can also be the outcome of a severe or catastrophic accident, like a car accident. Limbs are sometimes removed because of the following:

- A severe wound or infectious disease

- Gangrene infection

- Due to cancerous tissue

- Because of a bad accident

- Deformed limb

In this situation, you are highly likely to qualify for a successful TPD claim payout.

Other Common Medical Conditions for Disability Insurance Claims

Any physical injuries, chronic illnesses or psychological disorders that prevent you from working again in your regular occupation could qualify for both workers’ compensation benefits and a permanent disability TPD payout. Some other common conditions include:

Spinal Cord Injuries: Physical injuries such as back injuries and musculoskeletal disorders frequently account for TPD claims in Australia.

Chronic illnesses like diabetes and multiple sclerosis can lead to successful TPD claims due to their long-term effects on work capacity.

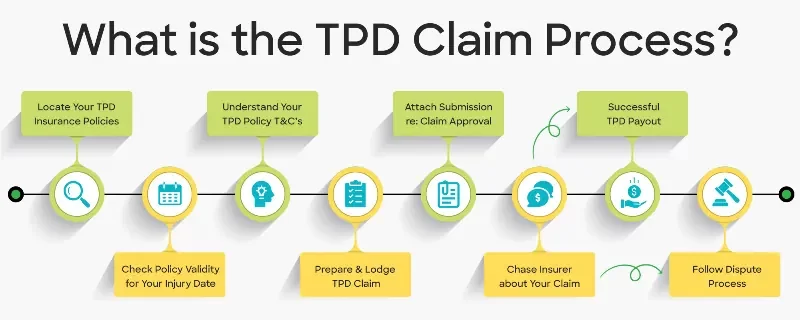

What is the Claim Process for Successful TPD Claims?

Filing a Total and Permanent Disability (TPD) claim can be a complex process that involves following specific steps. However, when you successfully lodge a TPD insurance claim, the insurance company deposits a lump sum TPD payout into your superannuation account. Each insurer has its own procedures which may alter the claim process, but the steps below generally apply to most cases.

- Contact a specialist TPD lawyer for a free claim investigation

- They will find all your TPD policies

- Notify the insurance company of your intention to make a claim, by phone or in writing, to start the process.

- Collect evidence, including relevant medical records, reports and assessments.

- File TPD claim forms

- Your TPD Claim is approved or rejected

- When approved, you get a lump sum benefit.

- If a TPD claim is denied, you can appeal the decision, which often involves submitting a written request for review.

- Rest assured, we have experienced TPD lawyers who understand the TPD claims process and know how to make a successful claim.

How a TPD Lawyer Helps Make a Successful TPD Claim

We have reviewed the most common TPD claims in Australia. However, any injury or illness can qualify for a TPD lump sum payment (including chronic diseases) when it prevents you from working.

Do you want to make a TPD claim but are unsure if you qualify? Our experienced lawyers will advise if you qualify for free. They understand the TPD claim requirements and assessment process, and have helped thousands of Australians make successful claims, including those unsure if they had a chance.

You can take comfort in knowing that our TPD claim specialists work to approve your claim quickly, with a 99% success rate.

All our personal injury law services are 100% no-win, no-fee. Pay our legal fees when you win and nothing if you lose. It’s the Aussie No Win, No Fee, No Risk guarantee. Call Now: 1300 873 252

Most Common TPD Claim FAQs

What Qualifies as a Total and Permanent Disability?

While the term “Total and Permanent Disability” can give the perception that you must have a serious injury or illness, this is not essential for a successful TPD claim. Getting a lump sum TPD payout generally relies on meeting the definition of total and permanent disability of your TPD policy.

Most claimants only need to show that a health issue prevents them from performing their regular occupation or a role for which they have training or experience. Generally, this requires your medical records and evidence to prove your case.

What percentage of TPD claims are successful in Australia?

In Australia (according to SuperRatings data), approximately 30% of insurance companies approve about 90% of TPD claims annually. However, statistics from the Australian Securities and Investments Commission (ASIC) reveal that at least 16% of TPD claims are denied annually, making them the most commonly rejected category of insurance claims.

Interestingly, the refusal rate varies significantly depending on the insurance company providing the TPD policy. For this reason, your best chance to successfully claim TPD is to work with a specialist TPD lawyer who knows the appeals process and has a 99% success rate – like Aussie Injury Lawyers.

Can I Make Multiple TPD Insurance Claims?

Some lucky Aussies can make multiple TPD claims for one injury or illness because they have contributed to multiple superannuation funds. Typically, people forget they contributed to a super fund because they shift jobs every few years. The good news is that even if you haven’t paid into a super account for a period, you could still have current total permanent disability insurance.

Unsure if you can lodge more than one TPD insurance claim? No problem. For free, Aussie Injury Lawyers will investigate your current insurance cover and advise on your best legal options for a TPD lump sum payment. Call Now – 1300 873 252

What is a typical TPD payout in Australia?

In Australia, TPD payout amounts range between $30,000 and $500,000. However, people with TPD insurance in multiple superannuation funds receive much more.

How does a TPD payout affect Centrelink payments?

People with successful TPD claims often question how TPD payouts affect Centrelink benefits. The good news is that there is generally no impact when you leave the funds in your existing superannuation account. However, there may be a Centrelink impact if you withdraw funds from your superannuation fund before retirement age.

Please consult a financial advisor before reducing your superannuation fund balance.

Can I make a TPD claim?

You can claim against your TPD insurance cover when an injury or illness stops you from working in your own occupation, or one for which you have training and experience. To successfully claim a TPD payment, you must prove how your Total and Permanent Disability disrupts your work capacity.

In Australia, TPD insurance companies generally seek to minimise or deny paying out benefits, which is when experienced TPD lawyers can help.

What is Own Occupation TPD Insurance?

Another common TPD claim in Australia is “Own Occupation.” Generally, there are two main types of TPD insurance through superannuation funds: “Own” and “Any Occupation” TPD insurance. The type you have will determine if you can work again after making a successful TPD claim.

To receive a TPD payout from an “Own Occupation” policy, you must prove your permanent disability prevents you from working in your usual job role or one for which you have education, training or experience. This type of TPD policy generally allows you to work again after receiving a lump sum payment, as long as you train to work in a different industry suited to your physical or mental disability.