TPD Definition: Guide to Total and Permanent Disability Insurance

The definition of Total and Permanent Disability (TPD) depends on

Our Sydney TPD lawyers offer expert legal advice regarding superannuation insurance and TPD claims on a 100% no win, no fee basis with 99% success rate. Daily, we help our clients access their entitlements in Sydney NSW, when an injury or illness stops them from working. With informed advice and experienced legal representation from an expert TPD lawyer, you have a strong chance of a winning outcome.

It is common for people to work most of their lives, contributing money into their Superannuation account with little or no knowledge of the insurance policies and the benefits due to them when the unexpected happens.

However, it’s not easy to access all your insurance benefits. Insurers often seek to deny or minimise claims. Avoid putting your trust in large insurance companies or battling their bureaucratic processes and stringent guidelines for TPD insurance claims. Allow Aussie Injury Lawyers to handle the burden for you. Call now for your free case review – 1300 873 252

Our Sydney insurance litigation law firm is at Level 17, Angel Place, 123 Pitt St, Sydney. The closest car park is Wilson Parking Australia Square if travelling by car.

If travelling by train, Wynyard Train Station is a 39-metre or 1-minute walk. Many people in the Sydney CBD now choose to travel by light rail, and the Bridge Street stop is very close to our Sydney location.

Our experienced TPD lawyers in Sydney are grateful for the opportunity to assist residents with a range of no-win, no legal fee services. Rely on our many years of experience helping people negotiate with all the leading insurers to access the TPD benefit in their Superannuation fund.

Ask a TPD lawyer about:

Wherever you reside in Sydney or New South Wales, we have a legal team of experienced solicitors ready to work with you and fight for your entitlements. Contact our friendly insurance claim lawyers now – Call 1300 873 252.

At Aussie Injury Lawyers Sydney, our 100% No Win No Fee legal funding means we’ll start work on your TPD claim with no upfront payment. You only pay our fees when we win your case, so there’s no risk to you with our no win, no fee policy. Relax knowing our compensation lawyers will support you through the claims process and relentlessly pursue your TPD insurance benefits through your superannuation fund.

Because of our extensive experience in these types of claims, we have a 99% success rate. In the rare situation where your claim is unsuccessful, knowing you will have no legal bill is reassuring.

Our legal fees are based on the hours of work required to deliver the results you seek; however, our fees are capped. You will know the maximum amount you would be charged and the possible settlement amount before we start work on your behalf.

Many Sydney and NSW workers have contributed money into their superannuation account (or their employer has, on their behalf). They have no idea of the insurance contained within their superannuation policy until the unexpected happens, and they can no longer work. You may have a physical injury or illness or a mental health condition that stops you from being employed in your usual occupation. The requirements list is extensive and can usually be found in the T&Cs of your insurance policy.

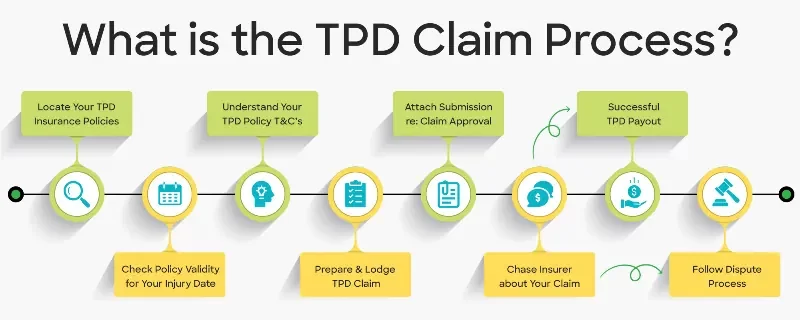

Does this sound like your situation? Share your story with us now; we can let you know your opportunity to make a successful disability claim. Call for a free case review. Your TPD assessment is free. You can discover how the claims process works here.

When you choose Aussie Injury Lawyers to manage your disability insurance claim, you are working with a team of specialist TPD lawyers focused on one area of law – insurance litigation. Unlike other injury compensation law firms that practice in many different legal areas, we are hyper-focused on just one. Because of this, our solicitors have substantial expertise when negotiating with large insurance companies and super funds.

Rely on our more than 100 years of combined legal experience with insurance claims matters, backed up by a 99% claim success track record. You can relax knowing that you will have a high chance of receiving all your lump sum benefits when we take on your case.

Total and permanent disability claims are not just for physical injury. You can also have a successful mental health super TPD claim or seek income protection insurance benefits for any medical illness that prevents you from doing your regular job. So, if you are living with:

or any other recognised mental illness, you could make a TPD compensation claim or access your income protection benefits.

When you are diagnosed with a critical medical condition that hinders your capacity to work in your regular occupation, you could have a successful disability insurance or income protection claim through your superannuation provider. Australians often don’t know they’re entitled to TTD payments or a TPD payout if they’ve been injured and can’t work. Any severe medical condition might qualify as a disability, but some common ailments include the following:

Common physical injuries that also frequently qualify as TPD include:

Be certain of your legal entitlements by speaking with our expert Sydney TPD lawyers now for your comprehensive free case review.

Aussie Injury Lawyers Sydney has the experience and expertise you need for a successful TPD claim. Our legal specialists are local, so we can easily handle cases for our clients in TPD or Superannuation Insurance claims! Every day, we assist the people of New South Wales and Sydney to gain access to their rightful disability insurance entitlements. We have seen it all and have the expertise to ensure your case succeeds. Contact us now for expert legal advice.

Find out now what your claim might be worth >

You don’t need a lawyer or solicitor to lodge a Total and Permanent Disability insurance claim. However, your chance of accessing benefits is higher when experienced superannuation lawyers support you.

Insurance companies want to minimise or deny your claim so they don’t pay too much for your injuries. They enjoy bargaining with claimants without legal representation because they will offer you a smaller lump sum TPD payment. An insurance law expert will help you get every dollar you deserve from your insurer.

If you’re trying to get a life-changing super TPD claim from an insurance company, you must put everything into it. Most Aussies only get a single shot at making a successful claim. Our legal team has been dealing with insurers for many decades.

Because of this, Australian injury lawyers have a 99 percent chance of winning their clients’ compensation claims. Contact us today to ensure you get all your TPD entitlements. It’s free to find out what you can claim and your chance of success.

First, contact our experienced disability insurance lawyers for a free case evaluation.

One of our friendly team members will seek to learn about your situation and explore your options. When you have a claim, we will find all your superannuation insurance agreements and assess your coverage. This process costs you nothing and will show you:

When you are happy to proceed, you sign a no-win, no-fee legal agreement, which triggers the work on your case. We create a compelling case and lodge it with your insurance company, challenging their decision if they try to deny your settlement. Following legal negotiations, you will get a TPD payout (or several payouts). Our lawyers and solicitors will happily explain this process to you when you contact us.

Time limits apply to insurance claims. If you think you have a case, contact us immediately. Early action can sometimes yield a better legal outcome. Our experienced TPD lawyers can assist you wherever you live in Australia, giving you access to substantial legal knowledge when claiming your insurance benefits from Murwillumbah to Bega and west to Broken Hill.

Aussie workers with multiple superannuation funds can sometimes make more than one claim. It isn’t straightforward to understand if you can have multiple claims. Several considerations are involved, including your medical history and the T&Cs of your insurance policies. Our friendly compensation lawyers will research your options for free.

When you contact us for your free case review, our best lawyers will explain the legal process and our costs, including managing your matter on a 100% no win, no fee basis. We will have already:

We follow the insurance claims process once you sign your legal cost agreement. Hence, based on our previous analysis, we will:

When you have a successful TPD claim, a lump sum payment is deposited in your superannuation account. If you leave these funds untouched until you retire and can access your superannuation funds tax-free, you will likely pay no tax on them. Tax will be payable if you take money out of your super account before this date, but usually at a lower rate.

Wherever you are in NSW, you can access experienced legal advice from our compensation lawyers and insurance claim experts. They will explain the claims process and give you your best chance of a successful lump sum payout.

From Byron Bay and the Northern Rivers to NSW South Coast, Greater Sydney Region, Coffs Harbour, Dubbo, Bourke, Bathurst, Newcastle, Wollongong, Wagga Wagga, Cobar, Armidale, Tamworth Penrith and the Blue Mountains and all surrounding areas.

Hardworking and straight-talking, our experienced superannuation lawyers are dedicated to delivering results for you. We understand how challenging life can be when dealing with the insurance industry, and we are here to help you claim TPD benefits.

Kerry Splatt, an Accredited Specialist in compensation law, leads the expert team at Aussie Injury Lawyers, with over 100 years of combined legal experience, is your guarantee of success. Reach out. Let us show how we can assist you and your loved ones when the unexpected happens.

The definition of Total and Permanent Disability (TPD) depends on

Our expert lawyers offer legal advice for amputation compensation claims

You can claim TPD and TTD insurance benefits simultaneously; however,